How to modify your VAT return after you submitted it

Read in 3 minutes

You had already closed your quarter and submitted your VAT return to Intervat … Suddenly you realize that you have not included a receipt or invoice in your VAT return. Good news: you can now modify the VAT return you submitted to Intervat, within the limits of the calendar. There are two ways of doing this. Here we give you the steps to follow, with the corresponding screenshots in Intervat.

Spoiler: While both methods are correct, the second method is much faster than the first! See for yourself:

Enter corrections in your VAT return, on Intervat, per screen

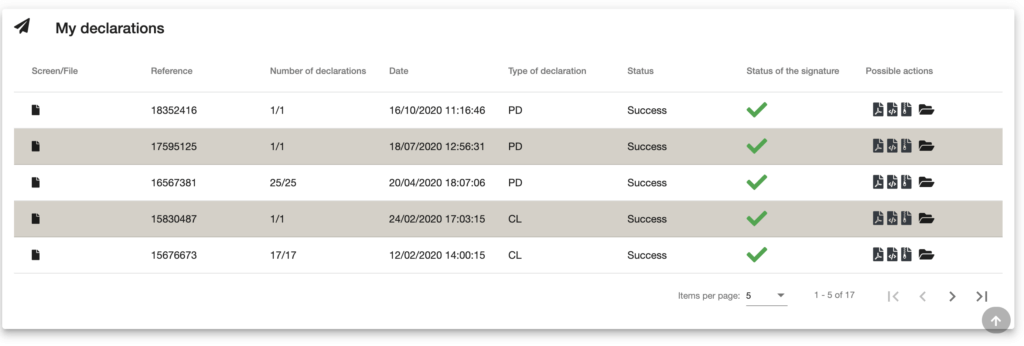

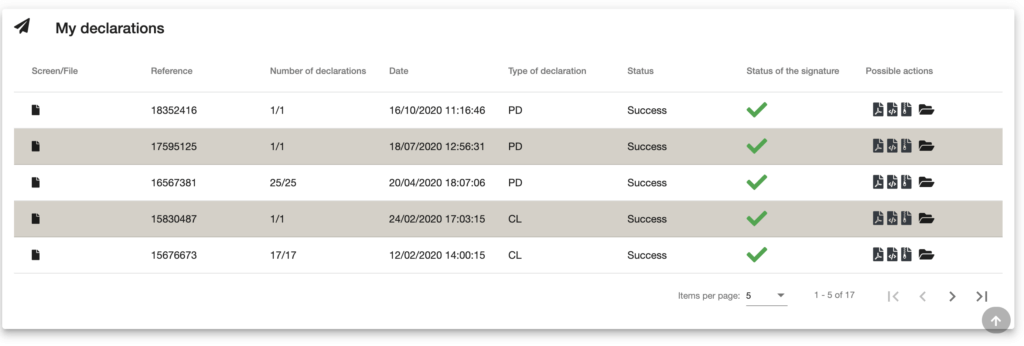

1. Find the reference number of the VAT return you want to correct

This number can be found in the acknowledgment of receipt of the VAT return. You can also find it by looking for the reference of your VAT return among your past returns, as on this screenshot :

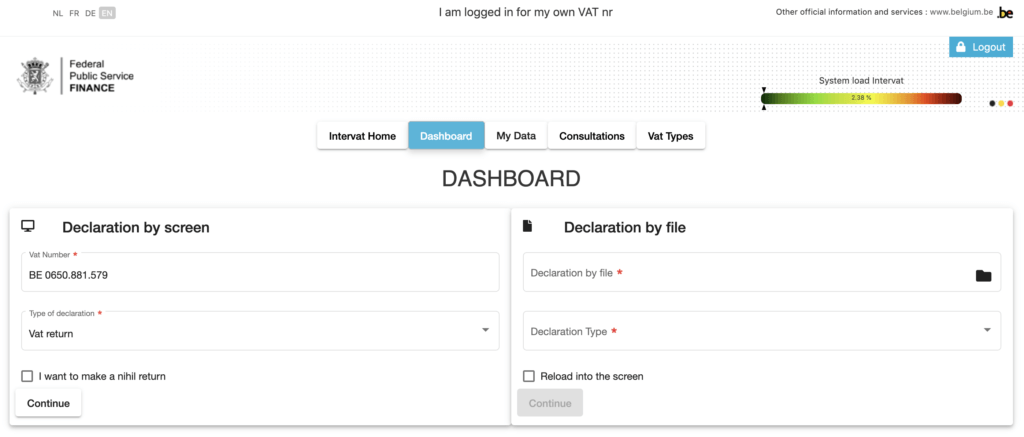

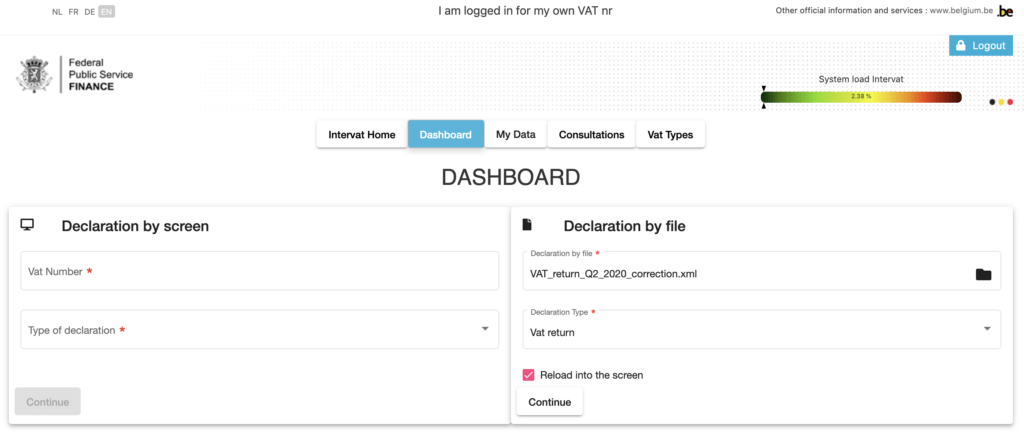

2. Submit the correction to your VAT return via “Declaration per screen”

This is done in the “dashboard” tab. On the left side of the screen, under “Declaration per screen”, you enter your VAT number and the type of declaration (periodic VAT declaration).

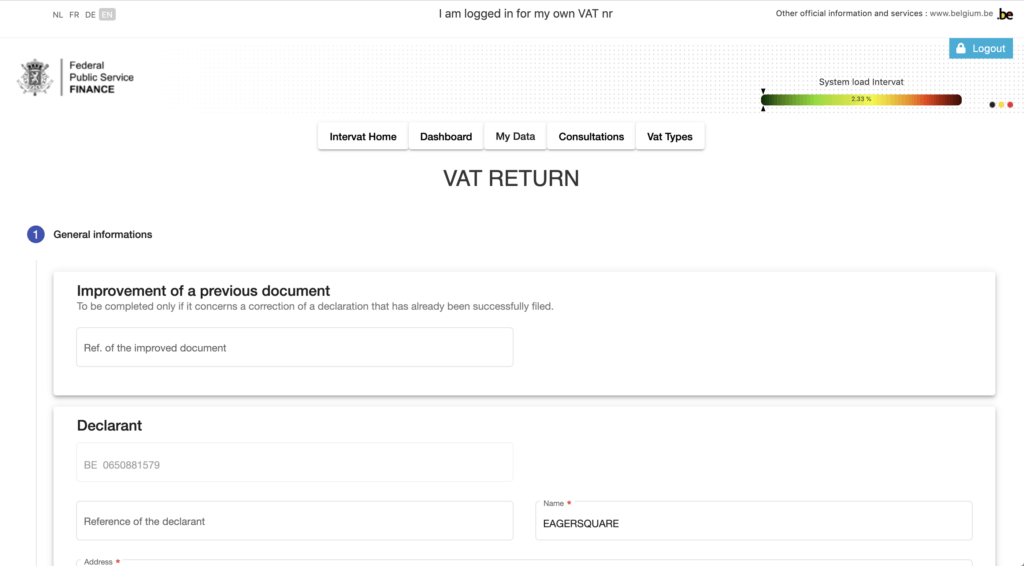

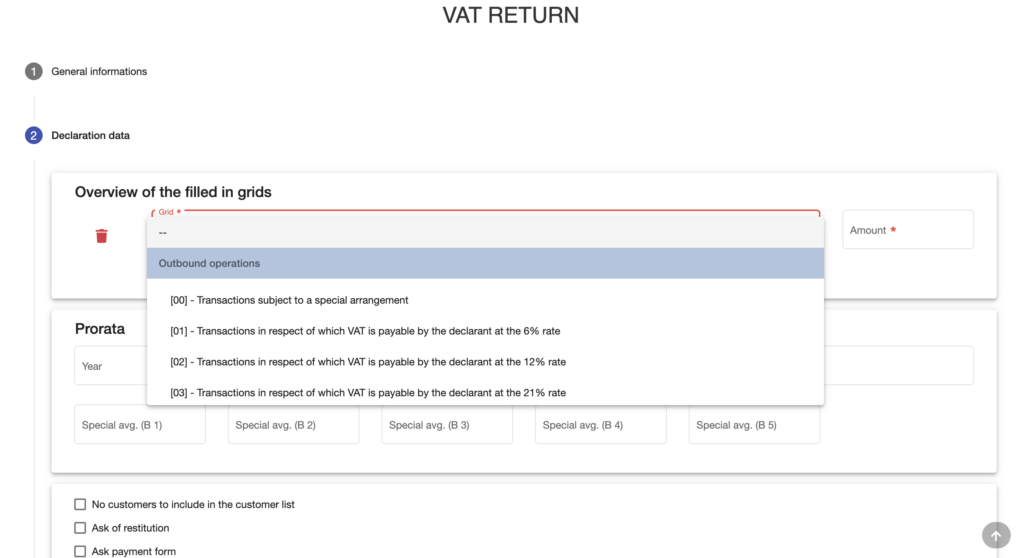

3. Enter your modifications, screen by screen, cell by cell

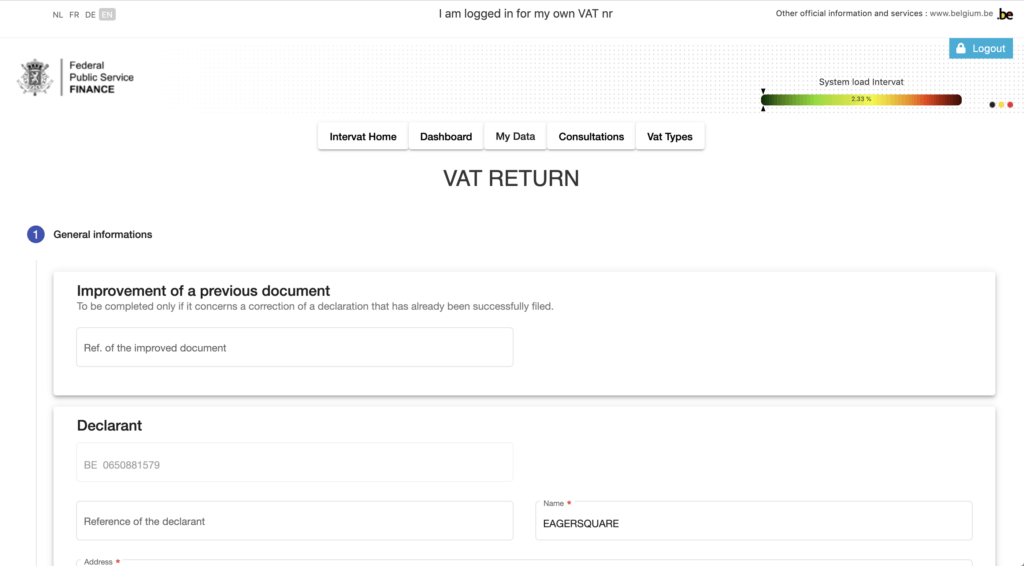

To do this, choose to correct a previous document (“Improvement of a previous document”) rather than entering a new one. Add the reference number you found in step 1.

You then encode, cell by cell, your new VAT return: in practice, you select the cells concerned in the Intervat drop-down menu and fill them in with the updated values.

You will find the values to be entered in our app, under “VAT return”, “VAT submission”.

4. Validate, sign, and you’re done!

You have the possibility to submit attachments or comments, you can simply skip this step, validate and sign the VAT declaration.

If your submission is successful, your mission is accomplished!

Even faster: submit a modified VAT return to Intervat

1. Find the reference number of the VAT return you want to correct

This number can be found in the acknowledgment of receipt of the VAT return. You can also find it by looking for the reference of your VAT return among your past returns, as on this screenshot :

2. Submit the correction to your VAT return via “Declaration by file”.

You generate your modified VAT return via our app. You will then receive the amended VAT return by email, in the appropriate format for Intervat (XML-file). You simply upload it in the right part of your dashboard, to “declaration by file” and choose “periodic VAT declaration” as declaration type. Don’t forget to tick the ‘Reload into the screen’ box before clicking on continue.

3. Choose “correction of a previous VAT return”.

This is when you need to enter the reference number of your VAT return, which you identified earlier.

4. Validate, sign, and you’re done!

You have the possibility to submit attachments or comments, you can simply skip this step, validate and sign the VAT return.

If your submission is successful, your mission is accomplished!

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.