What Is an Invoice and what does it include?

Read in 6 minutes

“Invoicing” is on your to-do list. Still, it tends to remain stuck at the bottom of this to-do list: who feels like drafting invoices after a long day or week of work?

Still, this is the only way to get paid for your work. Last but not least, the government itself expects you to do things right when it comes to invoicing.

Why?

If you are subject to VAT and selling goods or services to an entity also subject to VAT, you must send an invoice. You are a lawyer and your client is a software company? Send an invoice their way.

You also must invoice clients that are not subject to VAT themselves when you perform specific tasks for them. The full list is available here, in Dutch or French only, unfortunately, and includes among others moving or furniture storage, as well as deliveries by wholesalers or producers.

Keep an eye on the calendar: invoice no later than the 15th day of the month following the month in which taxes becomes due on all or part of the amount on your invoice, as laid out by the ministry of finance.

Thanks to your careful invoicing, the government monitors VAT amounts that are charged and will be paid to the government at some point. Also, invoicing in a clean and timely manner allows you to build and maintain a strong relationship with your clients.

Here is how to do things the right way: make sure that your invoices always contain these 10 indispensable elements.

- A sequence number. Your invoices follow each other: make sure that each invoice has the correct sequence number

- Your data; the exact name of your company, address, company registration number, and the VAT number

- The data of your customer; name, address and VAT number

- The issuing date of the invoice and the date on which your product or service was delivered

- A description of the delivered product or service

- The price per unit and the number of units (could also be hours)

- The total amount without VAT

- The correct VAT percentage that is relevant for your activity (6, 12 or 21%)

- In case you are exempted from VAT, you have to put the legal mentions explaining your exemption on the invoice. Accountable automates these legal mentions. If you cannot wait to see what they are, jump to the next paragraph.

- The total amount of money to be paid, including VAT

Next, to these mandatory items, we advise you to add the due date of the invoice, the details of your business bank account (IBAN + BIC), and your email. You should also include the terms and conditions you agreed upon with your customer upfront. These terms and conditions include e.g. fines in the event of a late- or non-payment and competent court in case of disputes.

If you do not create invoices or create them the wrong way, the VAT administration will show its teeth. You run the risk of a fine that can amount to twice the amount of the tax due on your transaction. If there was an intent to commit fraud or damage, the penalty is higher, and there is even a risk of going to jail.

Incorrect or incomplete invoices also open the way for your customer to contest them.

Why running these risks when issuing a correct invoice is quick and easy?

At Accountable we believe that you have worked hard enough to deliver to your client what he or she expects. You should not have to dedicate hours or days to your administration. You should not incur any bad surprise from the VAT administration because of your invoices.

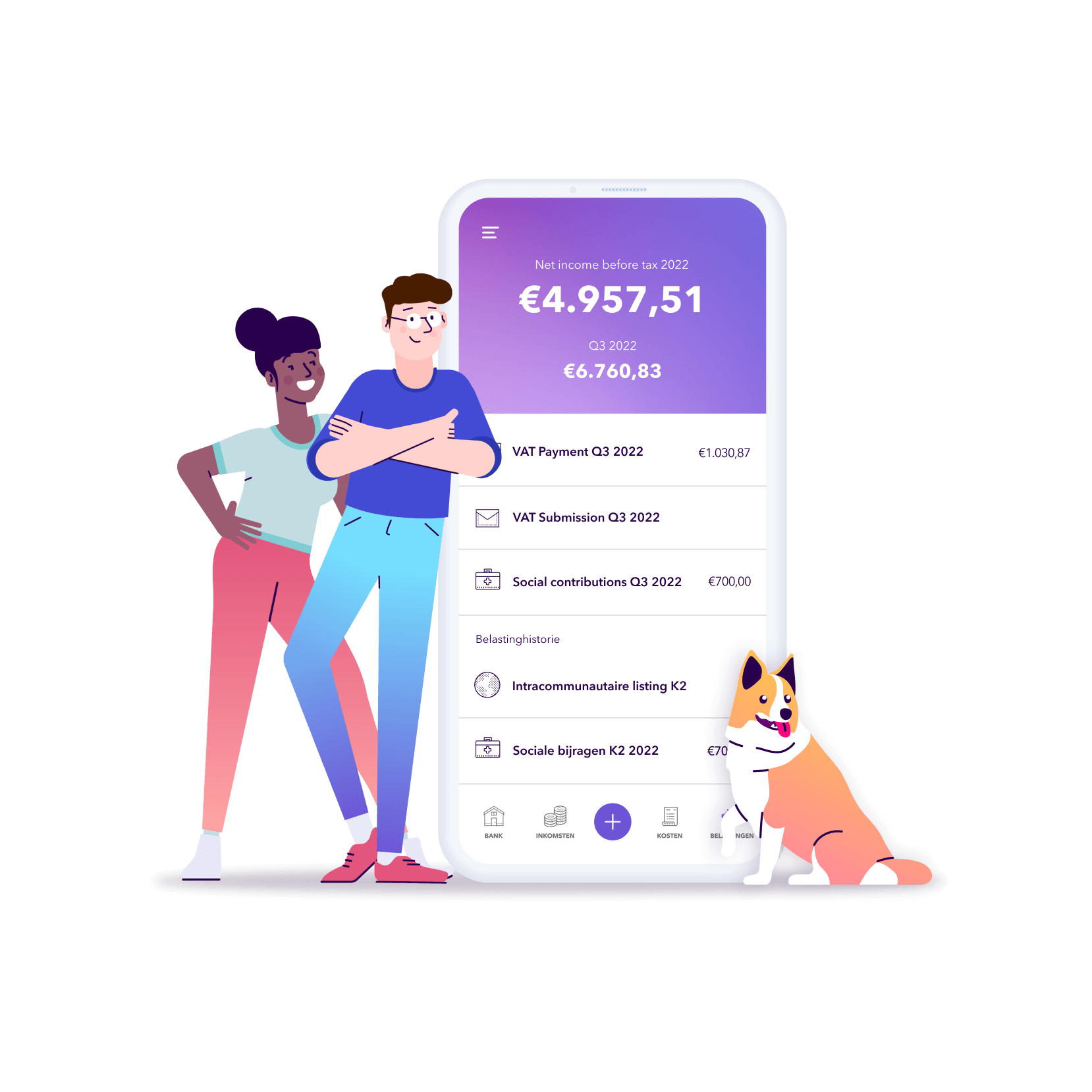

When using our app, you can draft and send a valid invoice in just a few taps, from your couch, while riding the public transport or even in the parking after visiting your client!

The invoice template in Accountable includes all the legally required fields. You fill them in, depending on the type of work that you are doing. You can even personalize your invoices as you like. In a couple of clicks, you send the invoice via email to your client or his colleague in charge of invoices. Via Accountable, the invoice is saved forever, at least for the lawfully required seven years, in the cloud.

Thanks to the connection with your professional bank account, the status of your invoice within the app switches. from “unpaid”, to “overdue” or “paid”.

If an item is missing (for example, your customer’s details or your VAT number), the invoice will automatically stay in draft within Accountable. In other words, you can’t send it to your customer if something is missing. This not-valid-yet invoice is not taken into account either for your tax calculations.

Using Accountable you can only send invoices that are fully legal. This is even easy and surprisingly fast.

If you like to go even faster, you can try the invoice template freely available here, that we designed based on our app experience.

This is our way to help you succeed as a self-employed worker.

VAT or no VAT? This is how you state this correctly on your invoice.

Thanks to you issuing invoices, the tax authorities know how much taxes you’re receiving and how much you should transfer to them – 6,12 or 21% of the total amount of the transaction.

Of course, it is also possible that your invoice doesn’t contain any VAT, in the event that the one or the other legal reason below applies to you.

What are these reasons?

- If your annual turnover is below 25.000 euro, you can choose to be exempted from VAT. You do not charge VAT, you do not deduct either from your purchases. If you opt for the VAT exemption, you need to state it clearly on all of your invoices with the following sentence “Special VAT scheme for small companies – VAT not applicable”.

- If you perform works in real-estate for a Belgian customer, then the VAT rate is 0%. You justify this on your invoices by stating “Reverse charge – Royal Decree No. 1, art. 20”

- You provide service between professionals (B2B) to a customer in the European Union, then the VAT rate is 0%. You justify this on your invoices by including the statement “Reverse charge – Article 196 of the Council Directive 2006/112/EC”.

- If you deliver an intra-community item to a customer in the European Union, the VAT percentage is 0%. Is this applicable for you? You have to put “Reverse charge – Article 138 (1) of the Council Directive 2006/112/EC”.

- If you’re exporting to a customer outside of the European Union, then the VAT percentage is also 0%. Don’t forget to mention “Exoneration – art. 146 of the Council Directive 2006/112 / EC ” on your invoices in this case.

When you use Accountable, you don’t have to copy paste these sentences on all the invoices you’re sending. Whichever option applies to you is automatically added on your invoices.

Would you rather use your own invoicing template? No problem at all: you send the PDF of your invoice to “revenue@accountable.eu” and it is automatically scanned and available for you in the app.

An invoice is also a way to communicate with your customer

An invoice is a legal document. If you did not know this before, you should know this by now 😉 When you’re using Accountable, you’re only sending legally correct invoices.

But an invoice is not only an obligation; it is also a way of communicating with our customer. You’re helping them to pay the invoice fully and on time. You’re giving them a picture of your company. You’re showing that you take your work seriously and that you would like to continue to work together in the future.

An invoice allows you to communicate all these things with your customer. That’s why when you use Accountable we offer the possibility to make the invoice look and feel exactly according to your company image.

Want to know how you can personalize your invoice?

Let’s have a look:

- Your terms and conditions; before you start working for a customer, you always must inform them of your terms and conditions to get off on the right foot. Your terms and conditions include elements like the competent court in the event of a dispute and the applicable fees in case of late payment. For most people, 10% of the total amount of the invoice is being charged in this case. Via Accountable, you are able to systematically add your terms and conditions on your invoice.

- Your logo; by including your logo, your invoice becomes instantly recognizable.

- Your branding colour; of course you’re free to use whatever colour you want on an invoice. By using your branding colours, you can make your invoice even more recognizable!

- The layout; by customizing the layout of your invoice, you are making it personal. This is also possible in Accountable.

Your invoice connects your customer with you and your company after you delivered your product or service. If your invoices are complete and coherent with your brand, you increase the odds of your customer paying your invoices on time, and remembering you and your good work.

By now, you know all about how to create legal and good-looking invoices, that your customer will want to pay right away. The only thing left is finding the time, a small but much-needed window, to work on it.

Are there other options you would like to have in your default invoice options in Accountable? Drop a comment below or leave us an email at hello@accountable.eu!

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.