Oops! Your tax assessment notice has arrived, and the amount you owe is higher than you expected. It's frustrating, but not exactly uncommon when you’re self-employed. Of course, you already know how important it is to set aside enough money for your taxes. Here, we share 5 practical tips for doing so effectively.

As a freelancer in Belgium, you charge your clients VAT. Generally speaking, the VAT rate is 21%. A €5,000 project therefore means an invoice of €6,050, VAT included, for your client. But be careful, the extra €1,050 that lands in your account isn't really yours.

In fact, you have to pay this VAT to the FPS Finance at the beginning of each quarter. So keep a close eye on the amount of VAT you receive and either don't spend it, or keep it in a separate bank account. That way, there’s no stress when it’s time to pay it back to the state.

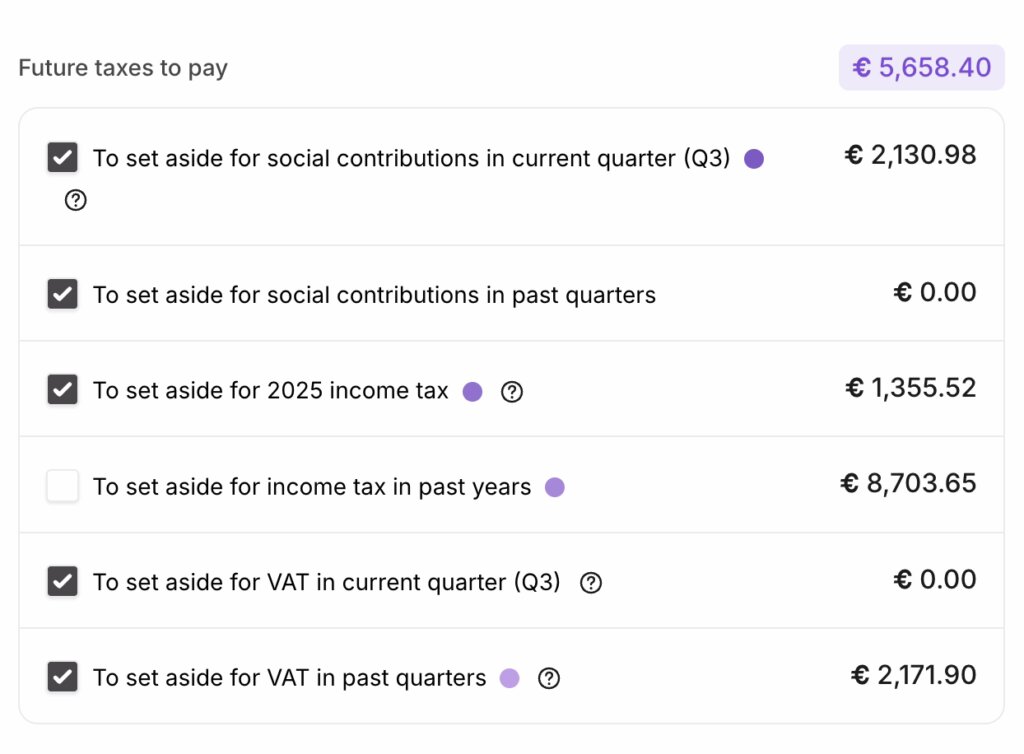

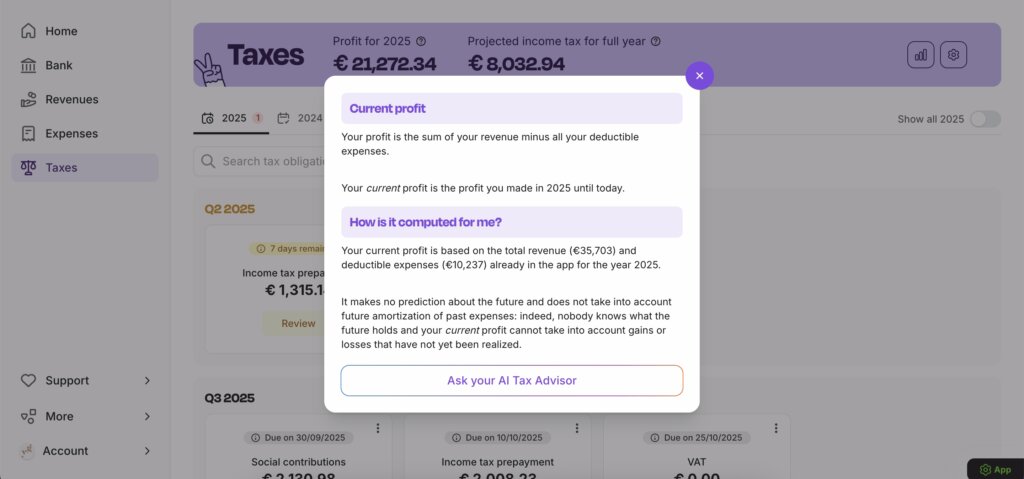

With Accountable, you can always see how much you should set aside for VAT, taxes and social security contributions.

Your taxes and social security contributions are calculated based on your taxable net income. This is your revenue minus your deductible expenses.

Let's say you have a revenue of €75,000 this year. Over the course of the year, you’ve incurred some expenses, like the purchase of a new smartphone, car charging costs, your internet subscription, a few business gifts, and of course, your social security contributions. In total, your expenses amount to €20,000. Your taxable income, therefore, will be €55,000.

This €55,000 is the amount on which you pay taxes, whether through personal income tax (if you’re a sole trader) or corporate tax (if you have a company).

You pay quarterly contributions and make advance payments for your taxes based on your estimated taxable net income. Having a good understanding of your financial situation allows you to make a more accurate estimate, which in turn makes it easier to calculate how much to set aside.

The more deductible expenses you have, the lower your taxable net income and, therefore, your overall tax burden. Visit deductibles.be for expense ideas.

By correctly estimating your taxable net income, you can also better assess the amount you’ll have to pay in social security contributions. These represent around 20.5% of your taxable net income.

You pay these social security contributions quarterly to your social insurance fund (Acerta, Partena Professional, Xerius, etc.). If you know your quarterly contribution, you can divide this amount by 4 and put a little money aside each month.

Example: In 2025, you pay €2,700 per quarter in social security contributions. You can therefore set aside €675 every month so you’re ready to pay your social security contributions at the end of each quarter.

During your first year of business, it’s not easy to estimate your income. You can therefore opt to pay the minimum social security contribution. Keep in mind, though, that if it turns out later that you earned more, the amount will be recalculated.

Learn more about how social security contributions are calculated.

As a self-employed sole trader, you pay on average between 25 and 45% in tax on your professional income. That’s a pretty large range, we realise.

To have a better idea, consider which tax bracket your business’ revenue falls into:

In Accountable, you can see at any time:

💡Are you self-employed with a company? The tax brackets above tell you the amount of tax you can expect to pay on the salary you pay yourself. Your company's profits will be taxed at a flat rate of 20 or 25%, depending on whether or not you meet the conditions for the reduced corporate tax rate.

When you’re self-employed in Belgium, you’re not required to make advance tax payments during your first three years of business. But this changes as of your fourth year; from then on, if you don't make advance payments, you’ll face an increase in tax.

In fact, it's worth making advance payments from the start. This allows you to spread the amount over the year and avoid having to pay a large sum of money in one go.

Of course, tax you pay in advance is money you no longer have at your disposal. If you’re just starting out as self-employed and don’t yet have a stable cash flow, it’s best to forget about these advance payments for now. After all, for the first 3 years, there’s no financial benefit in making such payments.

If you track your income and expenses in our app and connect your bank account, we'll tell you how much you need to set aside for your taxes at any time. You can check this using the 'Cash Available' feature.

🆕 Soon, we'll be introducing Accountable Banking, which will allow you to automatically save money for your taxes. Every time a client pays, the app will calculate the amount of tax due on the invoice. Then, you can choose to automatically transfer that amount to a separate tax savings account. Plus, it could earn you some money. Not bad, right?

Wondering if Accountable is a good fit for you? Try the app for free and get an idea of the taxes (and profits!) you can expect if you’re self-employed.

Author - Nicolas Quarré

Nicolas is co-founder and CEO at Accountable. His vision for the company has always been clear: free self-employed from administrative nightmares.

Who is Nicolas ?Thank you for your feedback!

Useful

As a self-employed individual with a sole proprietorship, your income is taxed under the personal in...

Read moreStarting from 2026, all self-employed individuals will need to send their invoices electronically in...

Read moreThe VAT reverse charge is a complicated word for a simple concept. It helps you purchase and sell sm...

Read moreCe serait bien de pouvoir créer des clients "différents" qui ont le même numéro de TVA (1 personne, même numéro de TVA mais adresses différentes par exemple).

Le Balai Magique SRL

Nous sommes très satisfaits jusqu'ici , du programme, du service et du soutien. Sommes encore en phase de découverte

Thibaud Deliège

Dit programma werkt heel aangenaam!! Super tevreden.

Anoniem

c'est super,j'avais une question et j'ai eu la réponse très rapidement.merci

caroline piot

mega overzichtelijk!!! TOP!!!

Deane De Coster

Impeccable Knowledge and support offered by Accountable Team. Thanks.

Ashish Jain

Facilité d'utilisatition - Clarté du processus de comptabilité

Michaël Arnhem

Ik heb nog nooit zo'n handige boekhouder gevonden :)

Charlotte Destoop

Rapidité et efficacité

Luis Angel Gonzalez Lopez

Merci de me faciliter la tâche au quotidien et aussi avoir une équipe toujours disponible. Merci

Japhet Nkouayi