Instructions for paying & declaring copyright revenue

Read in < 1 minute

Your supplier has sent you an invoice that includes copyright fees: you will find all the information you need to correctly process this invoice.

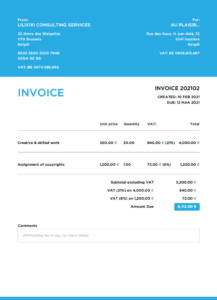

This invoice includes:

- The remuneration, to be paid to your supplier

4000 euros in the example - The copyright fees, to be paid to your supplier

1200 euros in the example - The withholding tax, to be paid to the authorities

90 euros in the example

This withholding tax is deducted at the source.

⏰ As a customer, you must therefore declare and pay it within 15 days of paying the invoice to the supplier.

You declare it here, on Myminfin, via the form 273S (in Dutch here, in French here).

As soon as you have declared this withholding tax, you will find the payment instructions again on Myminfin (information available only in NL and FR).

Your supplier will then see this information automatically appear in TaxOnWeb.

On your side, you fulfilled all of your obligations!

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.