How does Accountable reconcile documents and payments from my bank account?

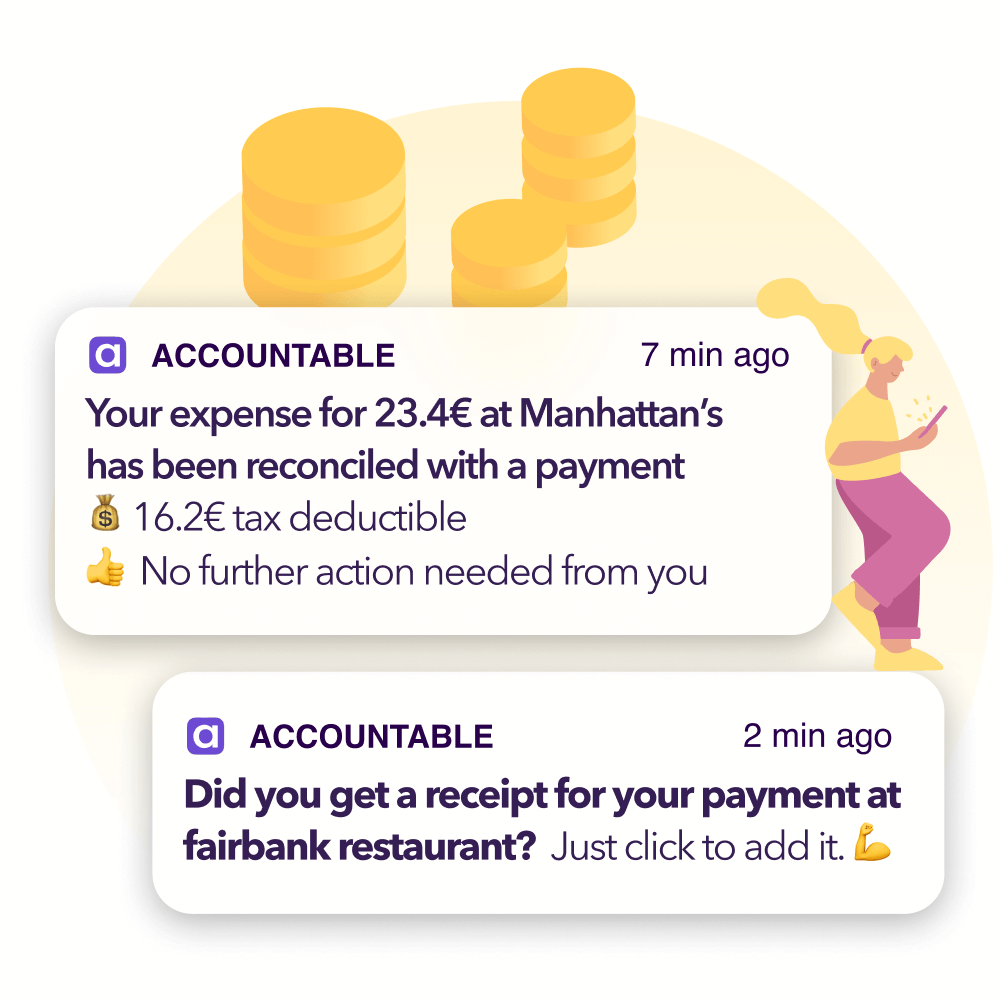

Once you connect your bank account, for each new payment you make we will search among existing expenses for a possible match. We will look at a variety of features such as amounts, dates & supplier names.

Also, every time you import a new expense, we will look for existing bank transactions that might match the expense. We'll notify you if it is the case, so that, at the end of the period, you have the peace of mind of knowing your bank transactions are backed by a document.

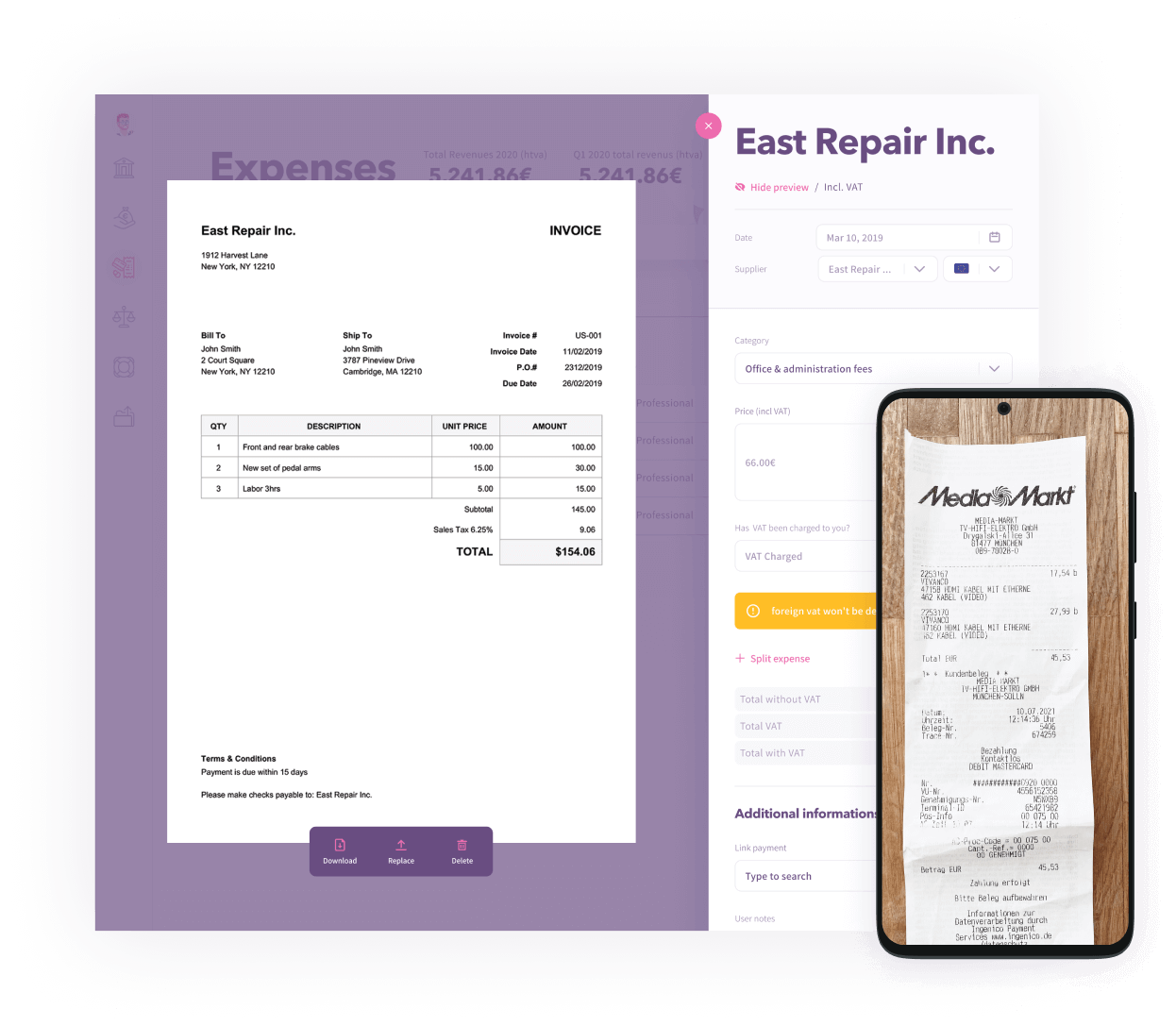

What happens if the app does not recognize the document?

It can happen, machines learn but also fail. In reality, it will happen 10-15% of the time. We hate to brag but we effectively have the best recognition rate in Belgium for such documents.

When it happens, no worries, you can simply add or correct any field you think is incorrect. The system will learn from your correction for the next import.

State of the art character recognition

State of the art character recognition  Automatic tax categorization of your expenses

Automatic tax categorization of your expenses  You receive a tax tip for every new expense

You receive a tax tip for every new expense

Payments automatically reconciled to expenses

Payments automatically reconciled to expenses  Be notified when a payment is missing a receipt

Be notified when a payment is missing a receipt  Connect up to 5 bank accounts

Connect up to 5 bank accounts

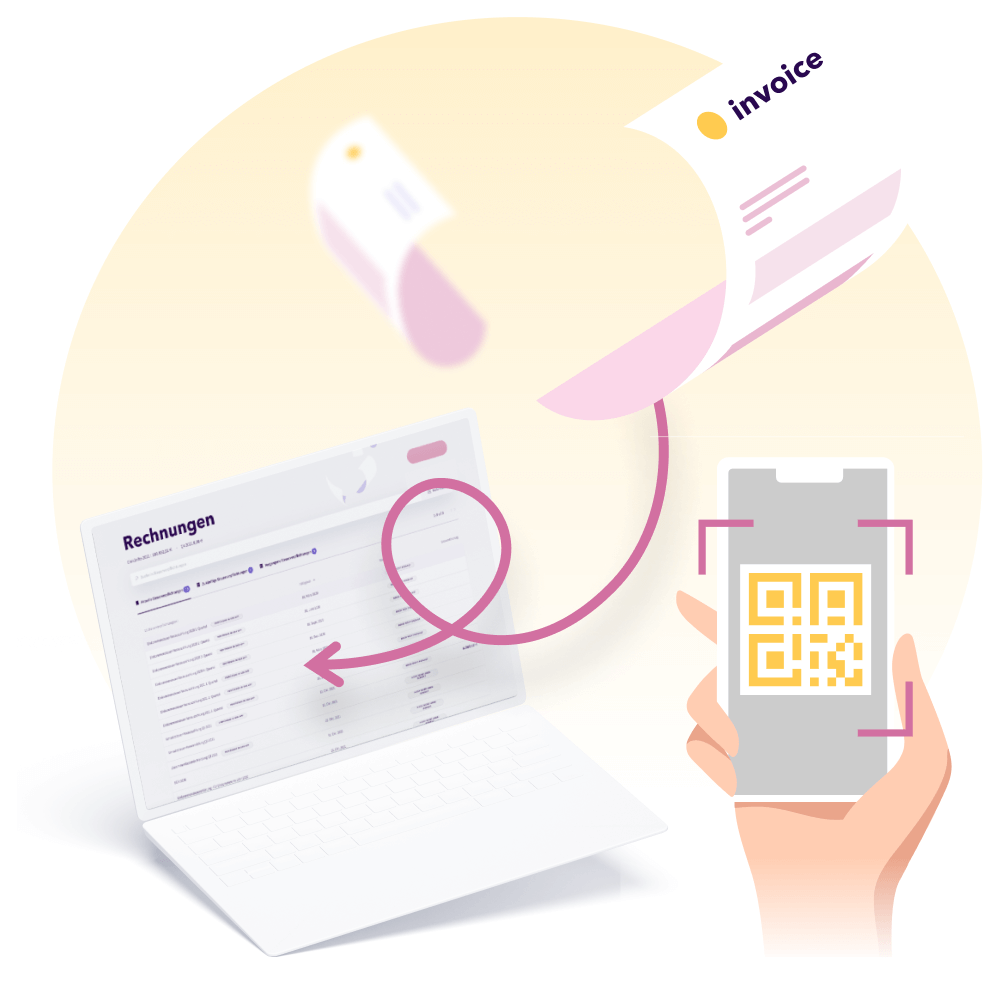

Import your invoices in the Web app

Import your invoices in the Web app  Scan the QR code with your bank app

Scan the QR code with your bank app  Your invoice is paid at due date

Your invoice is paid at due date