Everything you need to know about social contributions in Belgium

Read in 8 minutes

When you start working for yourself, you need to pay social contributions. Previously, your employer paid your social contributions through your salary, but now it’s your own responsibility. In principle, your social contributions represent about 20.5% of your earnings, but there are various exemptions and exceptions such as minimum contributions. Read on for all the details about social contributions, why you pay them, and how to calculate what you owe.

- What are social contributions?

- Why do you pay social contributions when you’re self-employed?

- How much do you pay in social contributions when you’re self-employed?

- Reduced social contributions as a starter

- How do you calculate your social contributions?

What are social contributions or social charges?

Social contributions are one of the legal obligations for self-employed individuals. By paying social contributions, you build up social rights. You pay the contributions through a social insurance fund that calculates how much you need to pay. Your contributions then go to the Belgian social security system to ensure a basic level of social security.

Why do you pay social contributions?

Your social contributions provide financial support during difficult or important times in your life, such as during illness or when you have a baby.

By paying social contributions quarterly, you build up social rights as a self-employed individual. These social rights are important for, among other things, paying your pension.

Thanks to the recent pension reform, the guaranteed minimum pension in 2024 will be €1,500, even for self-employed individuals. You can simulate how much you will receive once you reach the pension age of 67 years at www.mypension.be.

💡 Accountable tip: Not satisfied with your pension prospects? As a self-employed person, you can save for your pension in a tax-efficient way through the VSPSS/PCLI/VAPZ. This is also 100% deductible from your taxes. Win-win!

What else do you get in return for your social contributions?

Your pension will likely be the most important financial pillar of your contributions. Fortunately, you don’t have to wait so long for all the other benefits. Social contributions also provide security in good and bad times…

👶 Child support

Social contributions entitle you to a financial bonus for the birth or adoption of a child and a monthly child benefit thereafter. The starting amount is a fixed amount of around €1,200, and the monthly allowances depend on your income and family situation.

🤒 Health insurance

Social contributions also give you the right to partial reimbursement of medical costs and a sickness benefit in case you’re incapacitated for work.

If you’re temporarily unable to work due to health reasons, you’re entitled to a sickness benefit from your health insurance fund. You receive a benefit per day — Saturdays included — when you’re incapacitated for work for at least 8 days.

💡 Accountable tip: The sickness benefits are not very high and are not dependent on your income. If you want better coverage, it’s best to take out guaranteed income insurance.

👪 Benefits for parents

New mothers are entitled to 12 weeks of paid maternity leave — or 13 weeks for multiple births. Of those, 3 weeks are mandatory, and 9 are optional. These optional weeks can also be taken as 18 half weeks. For each week you take, you receive benefits, but from the 5th week, the weekly benefit decreases by about 10%.

Additionally, you are entitled to 105 free service vouchers for domestic help.

New fathers or co-parents are also entitled to 20 full days or 40 half days of paid paternity/co-parent/birth leave. You can schedule the days freely but must take them within four months of your child’s birth. You receive a fixed compensation per day.

🥀 The survivor’s pension

If you die during your career as a self-employed individual, your partner may be entitled to a survivor’s pension. In 2024, your partner must be at least 50 years old to benefit from this. This age limit will gradually increase to 55 years by 2030. The amount, like a regular pension, depends on your career and income.

If your partner is younger, they can claim a temporary transitional benefit. The amounts for this are also dependent on your career and income. The duration depends on the number of children and their age.

🛑 Bridging right

Self-employed individuals who have to stop their activities due to unforeseen circumstances, such as bankruptcy or economic difficulties, are eligible for a ‘bridging right’. This entitles you to benefits for 12 months and the retention of certain social rights.

👵 Caregiving by the self-employed

When a close relative is seriously ill, and you partially or fully interrupt your self-employed activities to care for them, you are entitled to a caregiving benefit. You can receive up to 6 months of benefits per application. However, over your entire career, you can only receive a maximum of 12 months of benefits. If you reduce your work by at least 50%, you receive half of the benefit.

If you completely interrupt your activity for at least 3 consecutive months and receive a benefit, you do not have to pay social contributions.

Social contributions according to your status as a self-employed person

As a self-employed person in a principal occupation, you will, of course, pay more social contributions than a student entrepreneur or a retired side earner. Discover the rules and minimum contributions for the different statuses below (numbers from 2024).

- Main occupation

- Secondary occupation

- Student entrepreneurs

- Retired side earners

- Assisting spouses

- Self-employed abroad

Social contributions for self-employed individuals in a principal occupation

As a self-employed person in a principal occupation, you pay 20.5% of your net taxable income, plus a small admin fee. This amount is divided by four to calculate your quarterly contribution. For starters and self-employed individuals with a lower income, there is a minimum contribution of about €890.51 per quarter. The exact amount depends on your social insurance fund.

On your net taxable income between €72,810.95 and €107,300.30, you only pay 14.16% social contributions. Anything above that is exempt from social contributions because the maximum contribution is €5,103.53 per quarter.

Social contributions for self-employed individuals in a secondary occupation

As a self-employed person in a secondary occupation, you already enjoy social rights as an employee or civil servant. Therefore, your social contributions make little difference to your social security. Your contribution is more of a solidarity contribution.

The rate of your contribution is the same as for self-employed individuals in a principal occupation: 20.5% of your net taxable income. If your taxable income in a secondary occupation is lower than €1,865.45 per year, you do not have to pay social contributions. If you earned more, as a starter, you pay a provisional contribution of €98,52 per quarter.

Social contributions for student entrepreneurs

As a student entrepreneur, you also pay social contributions, but the rates are much more favourable. Additionally, you can enjoy other benefits.

Student entrepreneurs who earn less than €8,430.73 net can apply for an exemption and do not have to pay social contributions.

With a net annual income of more than €8,430.73 but less than €16,861.46, you pay a reduced contribution. If you exceed the threshold of €16,861.46, you no longer receive a reduction and pay social contributions like a self-employed person in a principal occupation.

Social contributions for retired side earners

When you receive a pension and still work as a self-employed person, different rates apply to your social contributions.

Up to a net taxable annual income of €3,630.81, you pay a minimum contribution of €141.29. If you earn more, your contributions are calculated at a rate of 14.7%. As a retired self-employed individual, if your net taxable income exceeds €72,810.95 but is less than €107,300.30, you pay 14.16% in social contributions. The maximum contribution is €4,015.57. However, you do not build up further social rights.

💡 Accountable tip: For certain retired individuals with a self-employed activity, there is an income limit. If you exceed this limit, you receive less in pension.

Social contributions for assisting spouses

As the partner of a self-employed person in a principal occupation, you can apply for the status of ‘assisting spouse’. Under this status, you pay the same rates of social contributions as a self-employed person in a principal occupation: 20.5% up to €72,810.95 and 14.16% on the bracket up to €107,300.30. For assisting spouses, there is a minimum contribution of €391,20 per quarter.

💡 Accountable tip: You can only obtain this status if you do not have a full social status of your own. If you are employed elsewhere or a civil servant, you must become self-employed in a secondary occupation to help your partner.

Social contributions for self-employed individuals abroad

If you work abroad as a self-employed person, the situation is slightly different. You may continue to pay social contributions here. You may also have to pay social contributions locally, but there may be an agreement to transfer your social rights. Or, it may mean you no longer build up social rights in Belgium. In that case, it is best to join the Overseas Social Security.

💡 Accountable tip: Read more about your taxes and social contributions as an expat or digital nomad.

Are there exceptions or exemptions from social contributions?

If you are struggling financially, you can request an exemption from contributions or for paying the supplement after the regularisation of your professional income.

If you have the status of student entrepreneur, you pay no or fewer social contributions. Retirees who carry out a self-employed activity also pay a lower percentage.

You can also get a temporary exemption as a caregiver. And if you have to stop work for a long time due to a prolonged illness or accident, you can request an ‘assimilation due to illness’ (‘gelijkstelling wegens ziekte’/‘assimilation pour maladie’).

Social contributions as a starter

As a starter, you can pay provisional social contributions because your income is not yet known. In the first year, you then pay the minimum contribution. You can do this for three years. However, in many cases, it is better to increase your social contributions and pay based on your estimated income. This avoids having to pay a high amount when the regularisation is done.

If, during the regularisation, it turns out that you paid too much, you will be refunded the difference. But beware, this amount is taxed. If you paid too little, you must make up the difference, without having to pay a penalty. You usually receive this final bill about two years later in the second quarter.

If you were too optimistic in your income estimate and it turns out you will earn less, you can request a reduction in your social contributions. But be careful with this. If it later turns out that you have reduced your contributions too much, you will pay an additional amount on top of the regularisation.

How do you calculate social contributions as a self-employed individual?

Your social contributions are calculated based on your net taxable income, which is your income after deducting your professional expenses.

For a self-employed individual in a principal occupation, your social contribution is 20.5% of that income. In addition to your social contributions, you also pay about 3 to 4% in admin fees. This amount depends on your social insurance fund.

For example, when you pay €1,000 in social contributions at Liantis, they charge €39.50 in admin fees.

Since paying the minimum contribution for three years as a starter is risky, it’s advisable to calculate your social contribution based on your estimated income.

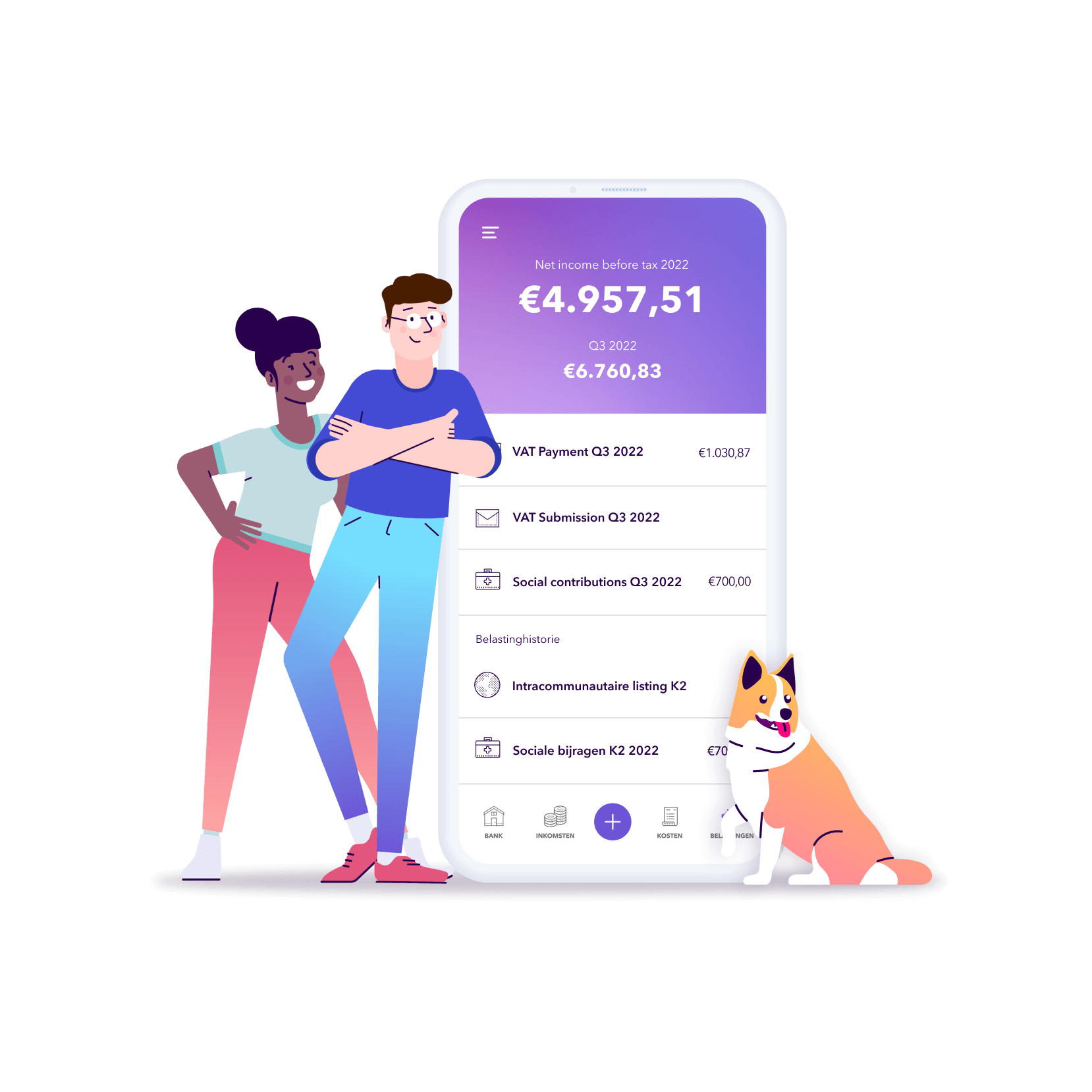

Accountable makes it easy for you. Our app calculates exactly how much you need to pay in social contributions and reminds you about the payment. Try Accountable now for a 14-day free trial!

Frequently asked questions about social contributions (FAQ)

Social contributions are a cost that you have to bear as a self-employed individual. So, indeed, you can deduct them from your taxable income. However, you do not pay VAT on social contributions, so these costs obviously do not qualify for your VAT declaration.

You pay your social contributions directly to your social insurance fund. You may receive a letter by post for this, but of course, it’s more environmentally friendly to manage your social contributions online via the client portal of your social insurance fund.

Self-employed individuals must pay their social contributions quarterly. In principle, they should be paid by the last day of March, June, September, and December. This means it’s best not to wait until the last day to transfer the money, as the amount might not appear in the social insurance fund’s account straight away.

If you don’t pay your social contributions on time, you pay a penalty. This amounts to 3% of the unpaid amount. Until your contribution is fully paid, there will be an additional 3% increase each quarter on the unpaid portion. Additionally, there can be a one-time increase of 7% if you have outstanding contributions on 31 December.

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.