Self-employed in a secondary occupation: 5 tips for your taxes

Read in 4 minutes

You probably decided to become self-employed in a secondary occupation because you wanted to earn a little extra money, pursue a passion, or test a business project. Not because you wanted to pay more in tax! This checklist will help you keep those taxes under control in Belgium.

- How much tax do I have to pay as a self-employed person in a secondary occupation?

- What expenses can I deduct when I’m self-employed in a secondary occupation?

- Why opt for flat-rate professional expenses?

- What social security contributions do I pay as a self-employed person in a secondary occupation?

- What is the VAT exemption scheme and how do you qualify?

How much tax do I have to pay as a self-employed person in a secondary occupation?

The income you generate as a self-employed person in a secondary occupation comes on top of your main income, i.e. your salary as an employee or your unemployment benefit if you’re unemployed.

However, the Belgian tax system is progressive. This means there’s a chance you’ll have to pay higher taxes on your additional income than you expected, even if that income is relatively low. This is because you pay taxes according to the tax bracket you’re in after adding up your main and additional income.

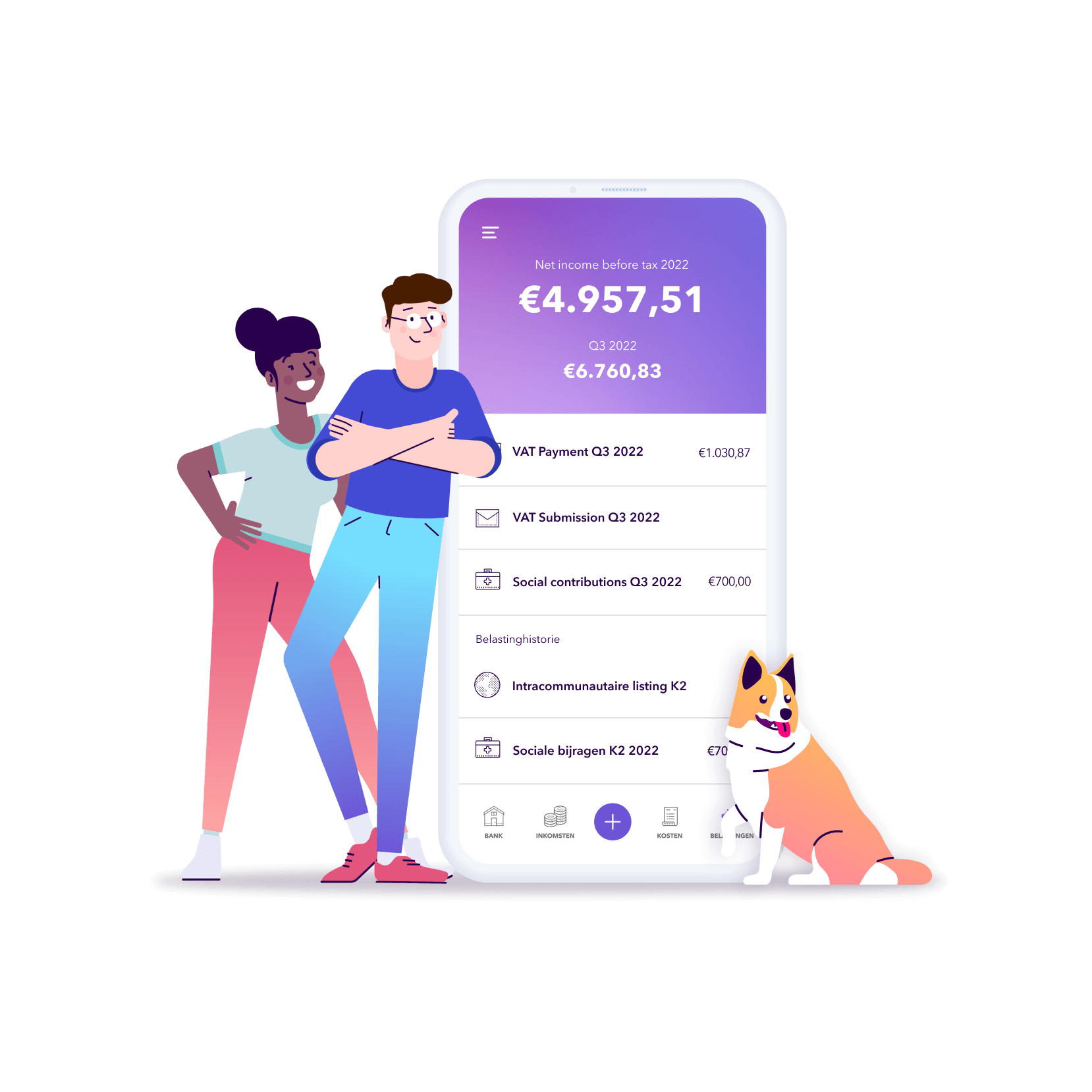

Want to avoid bad surprises? The Accountable app will help you understand your taxes better:

- You see in real time what your gross and net income is for your secondary activity.

- The app helps you optimise your taxes by making smart business expenses.

💡 Accountable tip: you report your additional income as a self-employed person in Part II of your tax return!

What expenses can I deduct when I’m self-employed in a secondary occupation?

To generate income, you probably need to incur business expenses. Are you a nurse during the week and a photographer in your spare time? Then you probably need a quality camera. This is a professional expense and one you can deduct from your taxable income.

💡 Accountable tip: the more expenses you deduct, the lower your taxable income, the less tax you pay.

But not all business expenses are 100% deductible. Are you buying a computer for your side business? Then you deduct a percentage of the amount excluding VAT, in proportion to the professional use of the computer. You’ll get 75% of the VAT back… if you’re liable for VAT, that is.

Check our searchable database of professional expenses to see which costs are deductible and typical amounts independents are deducting. If you enter these expenses in Accountable, you’ll immediately see their impact on your VAT return and social contributions.

Why opt for flat-rate professional expenses?

In recent years, things have changed for independents in Belgium: self-employed sole traders can opt to deduct expenses at a flat rate instead of actual expenses.

What does this mean concretely? That you no longer have to stress over all those receipts you keep somewhere deep in your wallet. You simply reduce your income by 30%, excluding the purchase of equipment and social contributions.

In other words, you can deduct your social contributions, and a maximum of €5,040 from your tax base. This system is attractive for independents who incur few expenses.

For others, it makes sense to stick to the system of declaring your actual expenses so you can directly influence your tax base and control the risk of landing in a higher tax bracket. Crunch the numbers before deciding one way or the other.

⚠️ Note that if you don’t enter actual expenses in your tax return, the tax authorities will automatically deduct the flat-rate amount you’re entitled to.

What social contributions do I pay as a self-employed person in a secondary occupation?

Just like someone who is self-employed in a primary occupation, if you are self-employed in a secondary occupation, you pay 20.5% of the income generated from your self-employed activities in social contributions. However, these contributions do not entitle you to any social rights – you get these through your main occupation. That’s why we call this amount a ‘solidarity contribution’.

- Still have no idea how much you’ll earn? If you’re in this situation, as a self-employed person in a secondary occupation you can opt for the minimum flat-rate contribution, which corresponds to 20.5% of an annual income of €1,865.45.

- Are you assuming your annual income from your secondary occupation will be higher? Then agree on the amount of your social contributions together with your social insurance fund. That way, you avoid painful regularisations when the tax authorities pass on your real income to your social security fund two years later.

- If your annual income is lower than €1,865.45 (for 2024), the contributions you paid will be refunded.

Accountable also helps you estimate the social contributions you’ll have to pay: go to the ‘Taxes’ screen and the ‘Social contributions’ tab. Once you’ve answered some questions, this tab will show the exact amount of social contributions you have to pay each month. That way, you won’t get any (bad) surprises later.

What is the VAT exemption scheme and how do you qualify?

Any business with an annual turnover below €25,000 is eligible for the VAT exemption scheme.

Concretely, this means that you must:

- not charge VAT to your clients,

- not pass on VAT to the Belgian state,

- not submit a VAT return.

On the other hand, this means you can’t deduct VAT from your suppliers’ invoices either.

Find out whether the VAT exemption is for you.

Before deciding ✋ read this checklist 👇

✅ As a self-employed person in a secondary occupation, can I offer attractive prices compared to competitors who are self-employed in a main occupation?

✅ Am I pursuing a complementary activity that doesn’t compete with my employer’s activity?

✅ Do I have enough free time and availability alongside my professional and private life to build up this secondary activity without getting overworked?

If the answer to all these questions is ‘yes’, go for it and… good luck!

Of course, there is some administrative work involved in being self-employed in a secondary occupation or being self-employed as a student. At Accountable, we do everything we can to reduce that workload. Download the app and find out how we do it!

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.