Social insurance funds: what are they, and which one to choose?

Read in 3 minutes

Are you considering becoming self-employed? Congratulations! Now you know exactly what activity you’ll be doing, it’s time to officially register your business with the Crossroads Bank for Enterprises (CBE). However, there’s one extremely important step you can’t skip: as a self-employed individual in Belgium, you must join a social insurance fund, also known as a social secretariat. This is a legal requirement and must be done before you start your activity. It applies to natural persons (sole proprietorships) in a primary or secondary occupation, as well as to companies.

When you’re starting out, there’s a lot of information coming your way, and it can be overwhelming. Hopefully, this blog will make things easier to understand.

- What does a social insurance fund do?

- What are social contributions, and why do you pay them?

- When should you join a social insurance fund?

- Which social insurance fund should you choose?

- How can you change your social insurance fund?

What does a social insurance fund do?

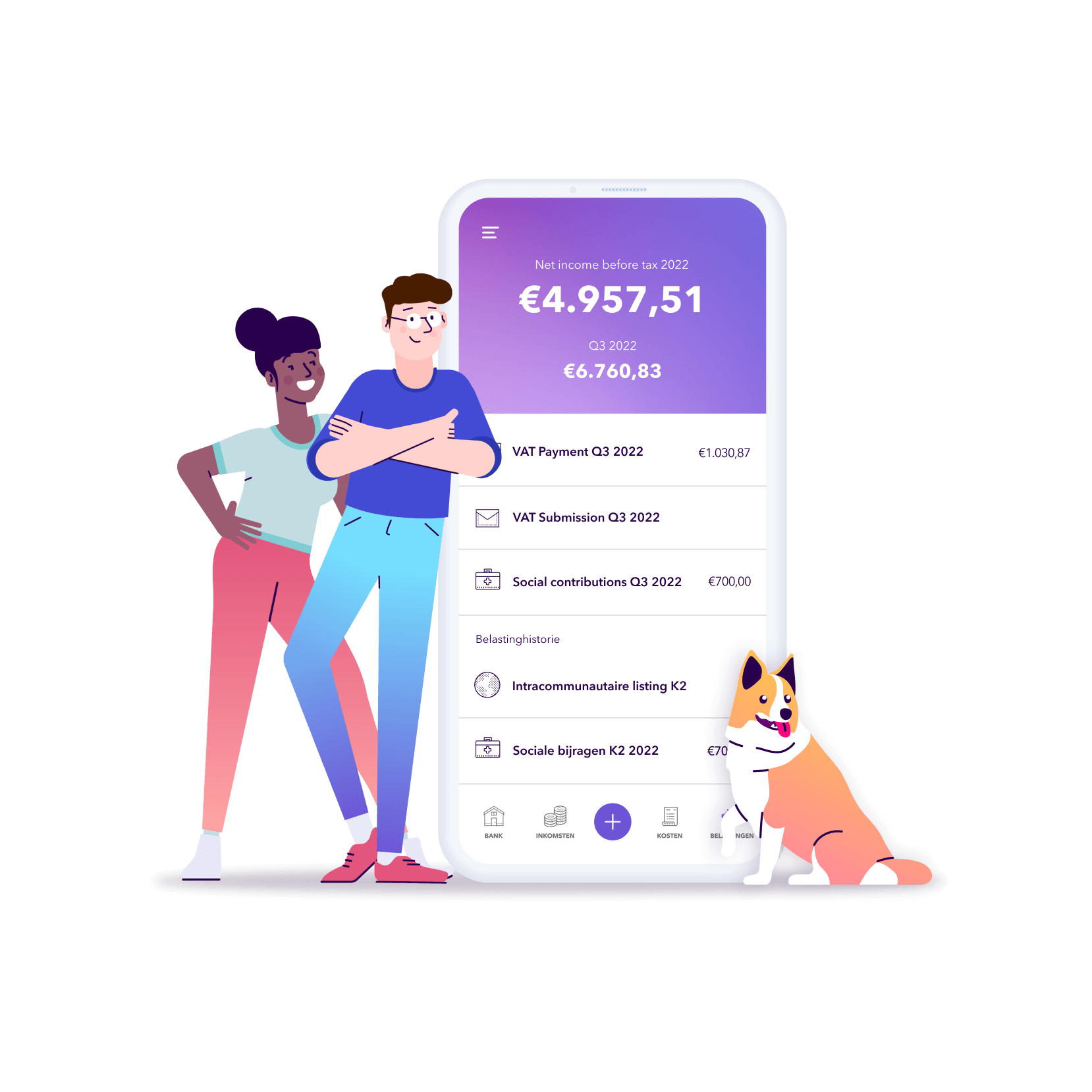

In Belgium, social insurance funds are responsible for calculating and collecting the social contributions of all self-employed entrepreneurs. They don’t keep these social contributions themselves, but rather transfer the amounts to the government. In return for the social contributions you pay each quarter as a self-employed person, you receive social protection.

In addition, the social secretariat is also responsible for managing your career data so you can, for example, claim your pension when you reach retirement age. Where relevant, they pay benefits such as maternity and paternity/co-parent leave, and they’re also responsible for the ‘bridging right’.

Finally, your social insurance fund serves as the contact point for all your questions regarding self-employment, social contributions, and your status as a self-employed person.

In short: An employee has an employer who handles these kinds of matters for them; a self-employed person can count on their social secretariat. So you’re not alone. 💜

What are social contributions, and why do you pay them?

You may already know this thanks to other self-employed people in your network, but as a self-employed person, you pay a social contribution every quarter. This is often a reasonably large sum of money, but in return, you receive social protection. The social rights you build up by paying social contributions include the right to:

👉 Reimbursement of medical expenses

👉 An allowance in case of illness or incapacity for work

👉 A pension

👉 Maternity/birth allowance, adoption premium, and monthly child benefit

👉 Paid maternity leave, paternity/co-parent leave or adoption leave

👉 Support as a caregiver

👉 The bridging right

👉 Bereavement leave

When you’re self-employed, your social contributions are a maximum of 20.5% of your net taxable income. When you start, it can sometimes be difficult to estimate your income because you simply don’t know yet how well your business will go. Therefore, as a starter, you can choose to pay the legal minimum contribution and gradually increase your social contributions as you earn more.

Note: Hospitalisation costs are only partially reimbursed through your social contributions and your health insurance fund. Therefore, additional hospitalisation insurance is advisable for everyone, including the self-employed. 🏥

💡Want to know more about social contributions? You can read all about them in this blog.

When should you join a social insurance fund?

Joining a social insurance fund is mandatory for all self-employed entrepreneurs in Belgium, whether you’re in a sole proprietorship (in a primary or secondary occupation) or have a company.

You must join a social insurance fund before you start your self-employed activity. Social secretariats usually also have a business counter that can help you register your business in the Crossroads Bank for Enterprises.

Do you already know what you’re going to do and what legal status you would like to have? And are all other preparations for your business made? If yes, you can register online via the business counter of your social secretariat. There’s a one-time fee of €105,50 for this. You can make changes to your legal status or business data later in the same way, but be aware, changes also cost money.

Which social insurance fund should you choose?

The choice is entirely up to you. It’s best to compare the services they offer and their rates when making a choice. The Accountable team ✨ or your accountant can support you in this.

These are the recognised social insurance funds in Belgium:

👉 Liantis

👉 Partena

👉 Xerius

👉 Acerta

👉 Securex

👉 Avixi

👉 UCM

👉 Group S

👉 National Fund

How can you change your social insurance fund?

Not satisfied with the social secretariat you chose? If you want to change social insurance funds, you can request to be affiliated with a different one. However, it’s important to know what the deadlines are and what steps you need to take if you change funds so you comply with legal obligations and avoid any penalties.

Starting your own business is not easy, but it’s absolutely worth it. And Accountable is there for you from the very start.

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.