Discover your AI Assistant: the new tax-ally for the self-employed in Belgium

Read in 3 minutes

As a self-employed person, juggling your taxes and accounts can eat up a lot of your time. And let’s not even start on the hassle of hunting down a reliable accountant in Belgium who can back you up. Thankfully, we’re not stuck in the past, and a swift, ever-present, and wallet-friendly solution has come to the fore: AI. In this piece, we’ll swiftly introduce you to our latest creation – the AI Tax Assistant. It’s an affordable, round-the-clock partner for every self-employed individual in Belgium, ready to simplify your financial management.

Struggling to find an accountant? You’re not alone

The self-employed sector in Belgium is booming. To give you an idea: in 2022, an impressive 120,000 new VAT-registered companies were added, bringing the total to around 1.2 million entrepreneurs. While this booming activity underscores a lively entrepreneurial spirit, it also brings to light a significant bottleneck: a severe shortage of qualified accountants, leading to many being turned away.

Accounting firms are at breaking point, often having to give preference to their larger clients. The routine nature of the administrative work associated with sole traders or individuals makes it less appealing and financially less rewarding for accountants. This has caused a strategic shift towards servicing larger entities, leaving the smaller players struggling to find the support they need.

Feeling the strain of an administrative nightmare and unnecessary stress? You’re not alone. Keep reading, because here at Accountable, we might just have the perfect solution for you.

Introducing our new AI Assistant ✨

With more self-employed individuals and fewer qualified accountants, the search for alternative solutions has never been more urgent. Thankfully, even the dreary tasks of tax filing and accounting are getting a digital makeover. Managing your accounts and taxes with AI? Absolutely doable!

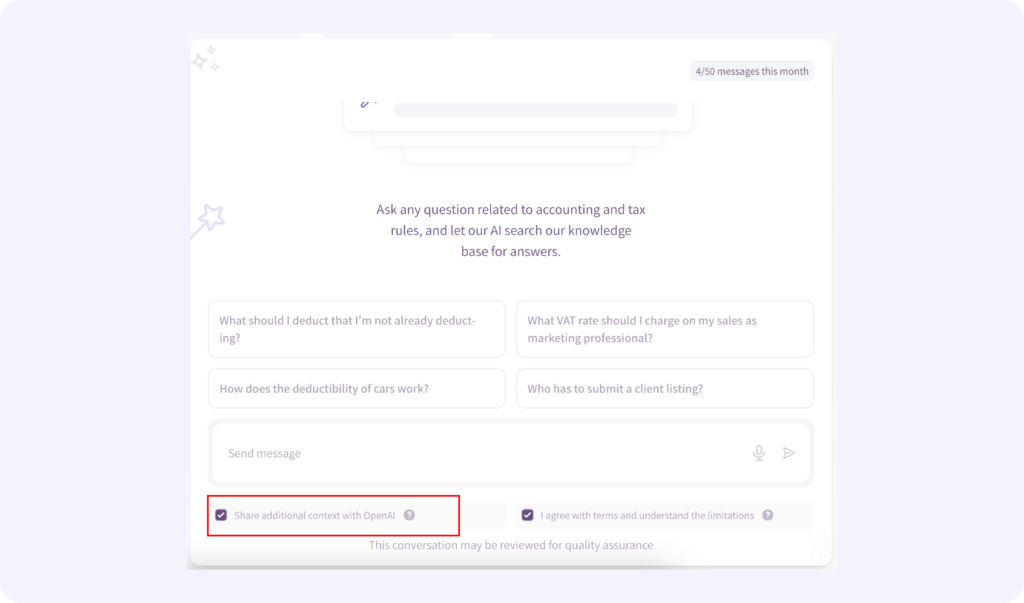

If you’re self-employed, chances are you’ve already harnessed artificial intelligence (AI) for various tasks, like drafting business emails, generating LinkedIn posts, or even creating your terms and conditions. Maybe you’ve even had a chat with ChatGPT to somewhat fill the gap of not having colleagues around in your solo venture? Well, now you can lean on AI for all your tax and accounting queries too. Enter our AI Assistant, ready to serve you as follows:

1. Tailored answers

Our AI Tax Assistant isn’t just any tool; it’s been rigorously trained with the most up-to-date tax information and regulations.

What’s more, this innovative AI is clued up on the common questions and answers that our Tax Coaches at Accountable deal with daily. This means you get accurate and swift responses to all your tax and accounting concerns as a self-employed individual, available 24/7.

2. Personalised financial advice

You have the option to grant the AI Tax Assistant unfettered access to your accounting records, paving the way for personalised advice. This is simply done by ticking the box for “Share additional context with OpenAI.” Rest assured, your name, VAT number, and other personal details remain strictly off-limits to OpenAI.

Queries such as “what should I know that I don’t yet?” are met with exceptionally precise answers, affording you tranquility and mastery over your finances as a self-employed professional.

If you’re debating whether to evolve from a sole proprietorship to a limited company, but are uncertain about the financial implications, our AI Tax Assistant is here to sift through the details with you, much like an accountant would provide similar counsel.

3. 100% Correct tax declarations and personalised tips

The AI Tax Assistant goes far beyond merely being a chat companion. This advanced software actively conducts tax checks and streamlines the sorting of expenses. It’s an all-encompassing tool that works relentlessly behind the scenes, making sure your tax matters are consistently spotless.

Additionally, you’ll benefit from bespoke tips tailored to your banking activities. Missed out on claiming potential professional expenses? That’s a thing of the past, thanks to the tailored tax advice from our AI Tax Assistant.

AI for your taxes and accounting: the benefits

- Our AI Tax Assistant and accounting software provide a solution for sole proprietorships with simplified accounting, eliminating the need for an accountant.

- The costs for an accountant or tax advisor can quickly skyrocket, but with our software, you pay a fixed price and avoid any unpleasant surprises.

- Get answers to all your questions and concerns, any time of the day, in just a few seconds.

- Thanks to our AI’s automatic tax checks, you can count on a 100% error-free tax return. Our tax guarantee backs up this promise.

We’re here to support you

We’re wholeheartedly convinced of our new AI Assistant’s capabilities, but that doesn’t mean you’re left without a human touch. At Accountable, additional support from our team of Tax Coaches is always just around the corner, ready to assist you.

Try Accountable and the AI Assistant now for free and don’t hesitate to share your feedback with us. 💜

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.