E-invoicing for the self-employed explained

Read in 4 minutes

As a business, you may invoice in any way you prefer, as long as the necessary information is on your invoice. Often, invoicing is still done by mail or through scanned PDFs. However, starting 2026, all invoicing between Belgian companies must be done with electronic invoices. Is this new requirement applicable to you as well? Continue reading to find an answer to all your questions.

What is e-invoicing?

An e-invoice is an invoice dispatched online adhering to a specific format. However, electronic invoicing isn’t quite the same as simply invoicing online. For instance, scanning an invoice and emailing it as a PDF doesn’t count as an e-invoice. An e-invoice, or digital invoice, must comply with certain standards ensuring the invoices can be accurately read and processed by invoicing software.

Naturally, e-invoices are also generated using invoicing software. Such software can, moreover, automatically send, receive, and handle your electronic invoices.

The European standard for e-invoicing

Some large corporations have been using electronic invoices since the 1980s. However, over the years, numerous electronic invoice formats have emerged. This complicated communication between companies, hindering the widespread adoption of e-invoicing. Yet, digital invoicing has gained significant momentum in recent years following European Directive 2014/55.

Since 2017, there’s been an European standard for sending, paying, and processing digital invoices according to a structured invoice format. This standard includes a list of all terms that may be used in electronic invoices and defines how these terms should be interpreted and utilized by software programs.

Furthermore, Europe developed the PEPPOL network for the exchange of electronic invoices within the European Union.

What exactly are the advantages of e-invoicing?

Every year, the government misses out on a hefty sum of tax revenue due to insufficient invoicing or outright fraud. Introducing mandatory e-invoicing will significantly complicate tax evasion in the future. Yet, that’s merely the tip of the iceberg in terms of e-invoicing benefits.

It’s a considerable leap forward for environmental conservation as well. Just think of the reductions in paper, ink, and postal deliveries.

But the perks extend to you as well. A substantial portion of invoicing and processing being automated means you’ll spend less time on these tasks. Furthermore, the likelihood of mistakes drops significantly due to the invoices’ standardized format.

While further advancements are on the drawing board, it’s quite feasible that e-invoicing could alleviate other administrative burdens down the line. For instance, VAT listings and declarations could also become (partially) automated once e-invoices become the norm.

How does e-invoicing work?

Electronic invoicing is facilitated through invoicing software that automates the sending, processing, and even payment of invoices. But what does that involve exactly?

To enable this, it’s crucial that the invoices follow specific standards and that the files can be easily read by the software. Therefore, you create e-invoices as XML files according to the UBL (Universal Business Language) format, which was specially developed for digital invoices. These standards ensure that all the necessary information for an invoice is indeed present.

Electronic invoices are sent — possibly automatically — to the recipient via a secure channel like PEPPOL. At the recipient’s end, the e-invoice can be directly incorporated into the accounting system for automatic processing. Since this program adheres to the same standards, the information can be easily read, and processing errors are rare. As a business owner, these channels also make it much easier to track the status of your invoices.

What is PEPPOL?

PEPPOL stands for Pan-European Public Procurement Online. It’s a framework designed for the real-time exchange of invoices between businesses, regardless of their size or location. This closed network was created to securely transmit digital business documents, such as invoices, within Europe. Meanwhile, companies from all continents can use PEPPOL for digital invoicing.

FAQ

E-invoicing is already mandatory for public contracts. From January 1, 2026, Belgian companies will also be required to invoice each other electronically. For now, there is no imminent obligation for e-invoicing to individuals.

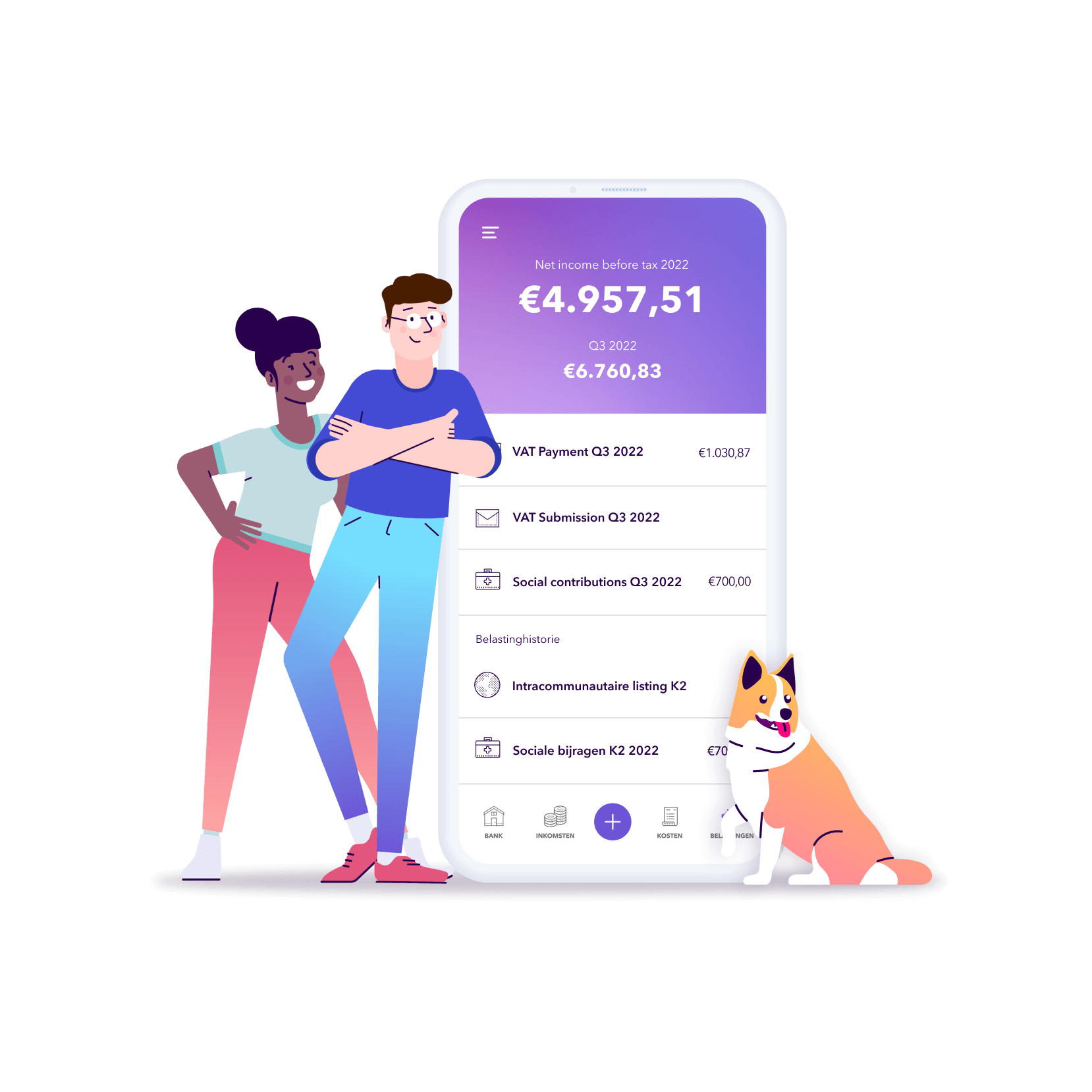

To start, you’ll need an e-invoicing software program. This could be part of a larger software package or a bespoke invoicing program tailored to your business. Accountable, for example, is a perfect accounting and invoicing program for freelancers and self-employed individuals. Your chosen program should also allow you to send invoices to businesses and individuals via Hermes. This tool ensures your invoices reach your client in a readable manner, even if they do not have a program to process e-invoices. It also allows you to track the processing of your invoices, just like on the Mercurius platform for public contracts.

There are no fees directly associated with e-invoicing, but you should consider your monthly software expenses. For example, Accountable costs about €20 to €30 per month, which is quite reasonable when you consider the cost savings associated with electronic invoicing. But the good news is that costs for e-invoicing are temporarily 120% deductible.

E-invoicing is safe as the invoices are sent through a closed network. These networks also require user identification to ensure that only authorized users can access the invoices. This also means you can be confident that the invoices are genuine rather than an attempt to deceive you.

You are not obliged to keep your e-invoices on paper, but you are allowed to. According to the Federal Public Service (FPS) Finance, you may “store invoices either on paper or electronically, regardless of the original format.

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.