Everything you need to know about using Upwork in Belgium

Read in 5 minutes

Are you starting out as a freelancer in Belgium and don’t know where to find exciting new projects to sink your teeth into? You’ve probably heard of Upwork. But what is it exactly and what can this platform do for you? Find the answers to all your questions in this blog!

- How does it work?

- How much does Upwork cost to use?

- Can anyone earn money with Upwork?

- How much do you keep from your Upwork earnings?

- How are Upwork earnings taxed in Belgium?

- What about VAT?

- Registering your Upwork income in Accountable

A freelance marketplace

Upwork is a kind of online marketplace for freelancers – you can offer your freelance services, or you can apply directly for open jobs posted by clients. As well as connecting clients and freelancers, the platform also provides a secure payment method between both parties.

Found a job that seems like a great match? You can send the client a cover letter briefly explaining who you are and what added value you can bring them. Clients often have a certain budget in mind for a project, but you can include your rates and availability when sending your cover letter. Some projects might be one-offs, while others can be recurring and long-term.

How does it work?

If a client thinks you’re a good match for their needs, they reach out to you, you agree together on how to proceed, and the collaboration can begin. Upwork protects both parties by working with contracts. A contract clearly describes what services are expected, within what timeframe, and for what price. Upwork also offers a chat function, which lets you ask questions directly to your client.

When the project is finished, you upload the work in Upwork and get the chance to close the contract and receive your money. You can also, in agreement with the client, extend the contract and get paid at the end of the project. In this way, Upwork offers protection to both parties; the client pays Upwork up front, but you only get paid when the work is submitted on time and is in line with what was agreed.

How much does Upwork cost to use?

Some freelancer platforms ask freelancers to pay a monthly subscription, while on others, the client bears the cost. In the case of Upwork, you, as a freelancer, give up a percentage of your earnings. This contribution to the platform is called the ‘freelancer service fee’.

Previously, the fee was 5, 10 or 20% depending on your income, but since May 2023, Upwork has opted for a flat rate of 10%. Freelancers who have been working on Upwork for some time and fall under the 5% scheme will still enjoy the 5% service fee on existing contracts until the end of 2023. From 2024, they too will automatically switch to a 10% fee.

Every cover letter you send to a potential client costs a certain number of ‘connects’. Connects are points, which you need to spend to apply for open jobs. Depending on the type of job, you need to spend between one and eight connects. Every month, you get ten free connects from Upwork, and when you win a project, you’re also rewarded with extra connects. If you’re getting low on connects or don’t have enough to pitch for a job, you can buy more for $0.15 each.

On Upwork, it’s not only freelancers who are supporting the platform. Clients pay $4.95 for each contract created and a 5% service fee on the amount they owe you.

💡Accountable tip: Upwork is a platform that operates from San Francisco, in the United States. The only currency used on the platform is the US dollar. One dollar is generally worth less than one euro, but, depending on the exchange rate, this can vary.

Can anyone earn money via Upwork?

If you’re self-employed, whether on a full-time or part-time basis, then you simply declare the income you generate via Upwork as you would any other freelance income.

However, if you’re an employee and you want to supplement your income via Upwork, in principle you need to register as part-time self-employed, i.e. self-employed in a secondary occupation.

What happens if you earn money through a one-off gig via Upwork? Then you can declare this income under the ‘miscellaneous income’ heading in your personal income tax declaration, and it will be taxed at 33%. And if it turns out to be more than a single gig? Then you need to follow the rules for being self-employed in a secondary occupation.

How much do you keep from your Upwork earnings?

Let’s say you work on a project and invoice your client $500. In principle, you get to keep $450. But only in principle, because you also have to take into account personal income tax, VAT, service charges and other costs.

You pay a 10% service charge in the form of the freelancer service fee, plus 21% VAT on that service charge. Plus, if you want to transfer your earnings to your bank account, you pay an additional $0.99 per transaction.

In exchange for your contribution, Upwork automatically generates invoices in your name and sends them to the client at the end of the project. So you can simply focus on your core business.

How are Upwork earnings taxed in Belgium?

From your hypothetical invoice of $500, you receive $438.51 in your bank account. However, you will be taxed on the invoice amount, minus the expenses you have incurred.

In this example, that’s $449.01 ($500 – $50 service charge – $0.99 transaction fee). Depending on which tax bracket your income falls in, the personal income tax rate varies between 25% and 50%. Remember that by deducting other professional expenses from your taxable income, you pay taxes on a smaller amount and therefore increase your net income.

What about VAT?

Despite Upwork being an American company, they do have a European VAT number. This means you pay 21% VAT on the freelancer service fees. If you are subject to VAT, in most cases you also have to collect VAT from your client. Upwork doesn’t do this automatically for you. Depending on which country your client is in, the VAT rules are different:

🌍 Within the EU: for services provided to a client within the European Union, the VAT reverse charge rules apply.

🌎 Outside the EU: for services provided to a client outside the European Union, you do not have to charge or pay VAT.

Registering your Upwork income in Accountable

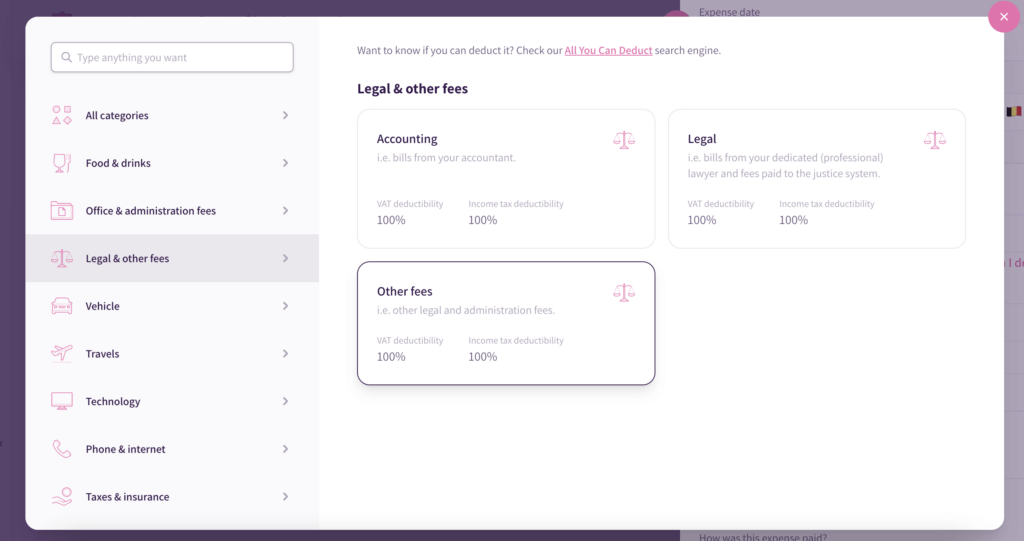

With Accountable, you can easily handle the income you generate from Upwork. Invoices generated by Upwork can be imported into your Accountable account in just one click. You then record the service costs under ‘Legal & other fees’.

Get started!

Have you found a nice gig on Upwork? Congratulations! Make sure to get good agreements in place from the very beginning about the content, delivery date, rate and the amount of work. This way, you create the right expectations, and the client will enjoy working with you all the more.

Good luck!

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.