Calculating your gross and net income when you’re self-employed in Belgium

Read in 6 minutes

The choice between remaining an employee or becoming self-employed often depends on how much net income you’ll have at the end of the month. To know whether you’ll earn enough to maintain the lifestyle you want, you need to be able to accurately convert your gross income to net income.

As an employee, your employer and the government handle this for you. However, when you’re a freelancer or self-employed, you’re on your own. Fortunately, calculating your net taxable income as a self-employed individual can be much easier if you know a few tips and tricks.

- What is your gross income?

- Calculating gross and net for self-employed individuals

- Example calculation

What is your gross income?

When you’re self-employed, essentially everything you receive from the sale of products and/or services is your gross income. Generally speaking, that’s all the amounts on your outgoing invoices added together.

Note that this never includes the VAT your customers pay you. This is a tax that goes entirely to the government at the end of the month or quarter.

When you sell a product or provide a service, you include the entire amount you receive for this in your gross income, also known as your turnover. It’s only when calculating your net income that you subtract expenses that you have incurred, e.g. for the purchase of products or services, from this gross amount.

How to calculate gross to net

After adding up all the amounts on your outgoing invoices (turnover), to find out your net income you need to take these outgoing expenses into account:

Social security contributions

Professional expenses

VAT

Future taxes

Your social contributions

Social contributions vary depending on how much you earn net on an annual basis. They’re subject to a minimum and a maximum limit. As a rule, you pay 20.5% on your net taxable income, unless you are above or below a certain income threshold.

The following figures are for 2023:

- The minimum contribution (net annual income < €16,409.20 in 2023) per quarter is €95.88 if you’re self-employed in a secondary occupation and €866.62 if you’re self-employed in a main occupation.

- The maximum contribution (net annual income > €104,422.24 in 2023) per quarter is €4,966.65.

You pay your social contributions every quarter. Therefore, to know how much you have to pay in social contributions every year, you need to multiply these amounts by four. Also, the amounts are indexed every year.

💡Accountable tip: By choosing to pay more social contributions, you avoid unpleasant surprises in the future. Because if you pay too little in social contributions, you’ll have to pay the difference later in any case. Besides, you can deduct social contributions as a professional expense, which immediately reduces your tax burden.

Your professional expenses

When you’re self-employed, you incur expenses. Whether it’s purchasing goods, buying a new laptop, or using electricity in your home office, you’re allowed to deduct the costs you incur to carry out your self-employed activity. Doing so reduces your net taxable income and hence, your tax burden.

Of course, you can’t just deduct all your expenses from your gross amount. You can only (partially) deduct expenses that have a clear link to your activity.

To find out exactly which costs you can deduct and whether they are 100% tax deductible, take a look here.

Incoming and outgoing VAT

As we mentioned before, incoming VAT isn’t included in your gross income. Nevertheless, it is important to understand the VAT principle.

If you’re not subject to VAT, you can skip this paragraph. Are you self-employed and subject to VAT? Then read on, because incoming VAT on your bank account can give a distorted picture.

The VAT you collect on products and services must be paid to the government every month or quarter. So this money is not for you. In exchange, however, you can (partially) recover the VAT you pay on professional purchases.

So to determine your net income, it is best to keep VAT out of the equation.

Your future taxes

By deducting all your professional expenses and social contributions from your turnover, you arrive at your net taxable income. From that net taxable income, you still have to pay personal income tax.

As a self-employed sole trader, you’ll be taxed under the personal income tax regime, with its progressive tax rates. To find out exactly how much tax you’ll have to pay and how much you’ll effectively have left over as net income, you can consult the tax rates on this page of the FPS Finances.

Are you feeling overwhelmed by all this information, or would you prefer a detailed example of how to calculate your net income as a self-employed individual or freelancer? Below, we’ll walk you through a hypothetical scenario.

Please note that depending on where you live, you might also be required to pay a communal or municipal tax (tax communale or gemeentebelasting). This tax rate can range from 0 to 9%. To find the accurate rate for your area, please check here.

Example gross to net calculation for sole proprietors in Belgium

- Gross income: Joris is a graphic designer and has a sole proprietorship. He adds up all the amounts (excluding VAT) on his outgoing invoices for the year 2023 and arrives at a total of €55,600. This is Joris’ gross income for 2023.

- Expenses and social contributions:

👨💻 Joris engaged a marketing agency this year to boost the visibility of his website (€4,500) and incurred some other expenses, such as travel to clients by train and bus (€600), some office equipment (cost: €300) and some software licences for creating designs (€1,200). Total cost: €6,600.

💸 Joris pays €2,397.35 in social contributions each quarter. This comes to an annual amount of €9,589.40.

- The net taxable income for 2023 in this example is therefore €39,410.60.

This is how we calculated it: €55,600 (turnover) – €16,189.40 (professional expenses and social contributions).

Progressive personal income tax

Now we know Joris’ net taxable income, we can calculate the estimated income tax. There are two steps in the income tax calculation

Step 1. Calculate your net taxable income following the progressive income tax rate

As a sole proprietor in Belgium, your taxes are calculated based on the progressive personal income tax system. This means the more you earn, the higher the tax rate you pay. Here are the tax brackets for the tax year 2024 (based on the income year 2023).

| Bracket 1 | 0,01 – 15,200 euros | 25% |

| Bracket 2 | 15,200 – 26,830 euros | 40% |

| Bracket 3 | 26,830 – 46,440 euros | 45% |

| Bracket 4 | More than 46,440 euros | 50% |

💡Want to learn more about the progressive tax brackets? Check out this article.

Calculation:

- The first bracket €0 – €15,200 is taxed at 25%.

€15,200 x 25% = €3,800 - The second bracket €15,200 – €26,830 is taxed at 40%.

€11,630 (26,830 – 15,200) x 40% = €4,652 - The third bracket €26,830 – €46,440 is taxed at 45%.

Joris’ net taxable income is €39,410.60.

€5,980.60 x 45% (39,410.60 – 26,830) = €5,661.27 - If your net taxable income exceeds €46,440, you will also be subject to the 50% tax bracket.

- Now, we add up the three amounts, resulting in a total of €14,113.27 in personal income tax.

Step 2: Applying the tax-free amount

Suppose that Joris is entitled to a tax-free allowance of €10,160. This amount will also be taxed according to the progressive tax brackets.

The first tax bracket for the tax-free allowance ranges from €0 to €10,680 and is taxed at 25%.

Therefore, €10,160 (€10,160 – €0) x 25% equals €2,540.

Joris must now pay € 11.573,27 in taxes. Calculated as follows: €14,113.27 (personal income tax from step 1) minus €2,540 (tax-free allowance) equals € 11.573,27.

Therefore, Joris’s net income is €27,837.33 (net taxable income – personal income tax). This means he can assign himself a maximum “salary” of €2,319.78 per month.

Remember, this calculation may vary depending on your personal circumstances, tax-free allowance, and municipal tax. For more accurate information, contact our tax coaches or an accountant.

💡Accountable tip: In this example, Joris pays a big amount of personal income tax. By cleverly bringing in professional expenses, you can optimise your taxes and have more net income left over. Our Tax Coaches or our professional expenses search engine can help you do this. Don’t be a Joris, optimise your taxes and don’t leave money lying around!

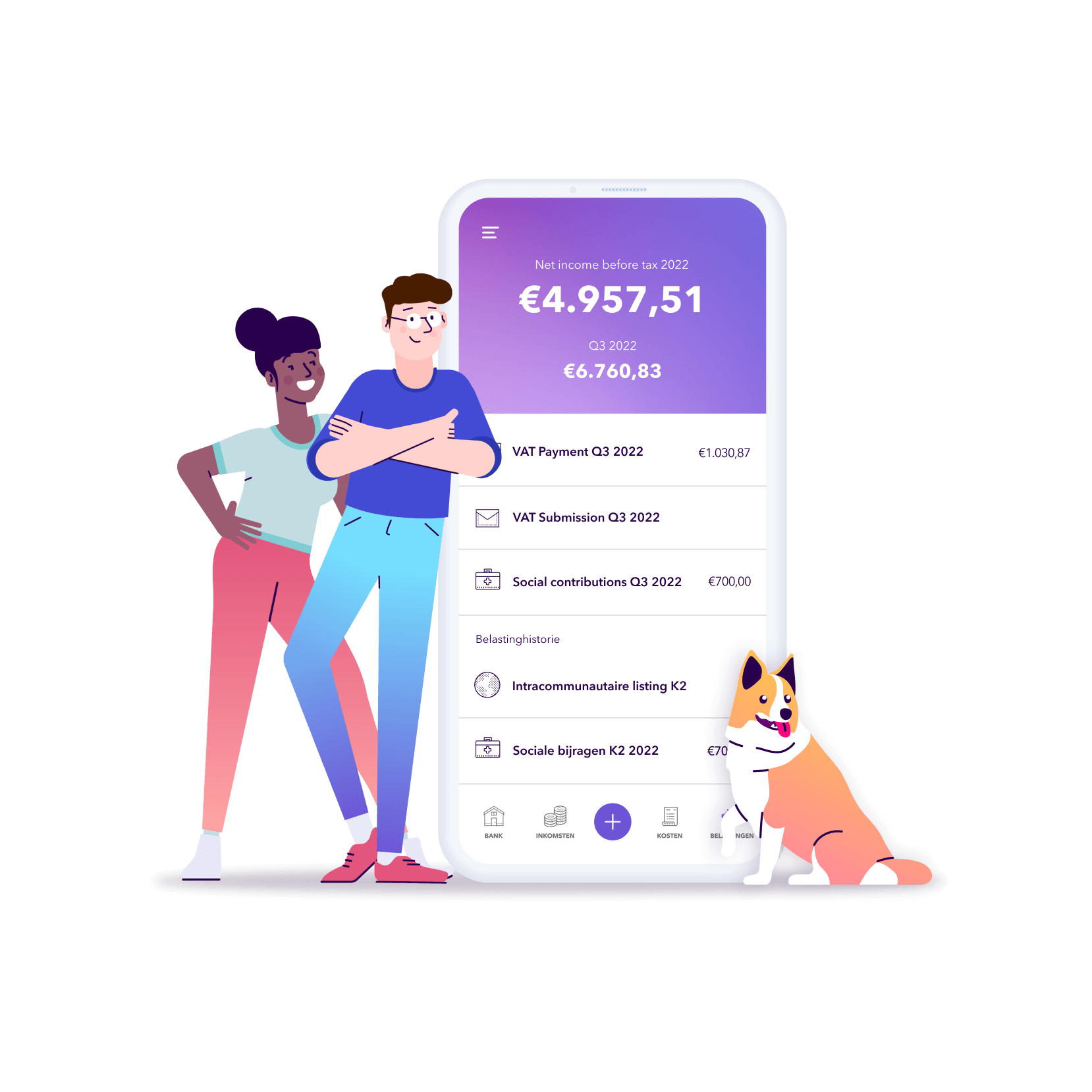

Avoid surprises: get a clear picture of your net income

Getting a 100% accurate picture of your net income when you’re freelancing or self-employed is difficult. There are many factors that can affect the final figure, such as unexpected professional expenses or recoverable VAT. You often only know after the end of the year how much you’re really left with in terms of net income. But of course, that’s a bit late to find out, because you obviously want to know how much money you can spend each month.

Even so, the tips and calculations above can give you a good idea of how much your net income is when you’re self-employed.

To accurately and (almost) effortlessly keep track of your expenses and income (and optimise them fiscally), there’s Accountable. Try it now for free. ✨

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.