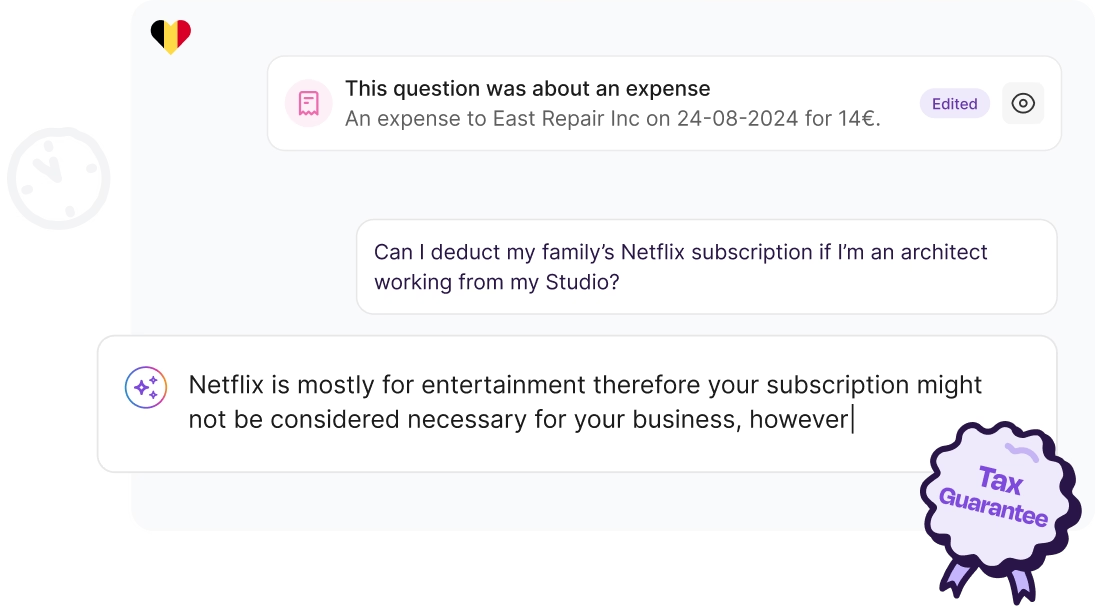

Your AI Tax Advisor answers your questions, automates tasks and uncovers deductibles - all covered by the Accountable Tax Guarantee.

All our tax and accounting knowledge is manually vetted by experts.

AI can be wrong. Consider checking important information. Conversations may be reviewed for quality assurance.

What data is shared?

Accountable’s AI Tax Advisor is designed to support freelancers and the self-employed with their tax issues. Here are some of the ways it can help you:

The AI Tax Advisor has been specifically trained with up-to-date and comprehensive tax information based on tax laws, expert advice, and Accountable’s extensive tax knowledge database. It is additionally continuously refined by Certified Tax Advisors. This makes it a reliable help for self-employed individuals who want to manage their taxes efficiently and correctly.

We take concerns about data protection and the security of your personal information extremely serious. <br>Here is some important information about the use of AI in Accountable:

For more details on privacy practices, you can access Accountable’s full privacy policy here.

Yes, Accountable’s AI Tax Advisor can help you with your tax returns and Accountable offers a Tax Guarantee for your submitted tax returns. Here are the key points:

If you have questions that the AI assistant can’t answer, you can contact Accountable’s Tax Coaches.<br>

This combination of AI support and human expertise is designed to help you file your taxes accurately and stress-free.

More information about the tax guarantee can be found here

More details about the AI tax assistant can be found here

Yes, for many self-employed individuals, we believe the AI Tax Advisor can effectively replace the need for a traditional accountant—especially given how challenging it can be to find an accountant who accepts self-employed clients. Our AI is equipped to handle a wide range of everyday tax questions and tasks, such as advising on tax deductions or helping you understand correspondence from the tax office.

For more complex tax issues or specific advice concerning Accountable, our tax coaches are available through the app and typically respond within 24 hours. If you need more in-depth assistance, we also offer the option to book a consultation with a partner tax advisor at a fixed rate.

Additionally, Accountable provides a tax guarantee covering up to €5,000 in back taxes if errors occur due to the app.

While the AI and our tax coaches offer robust support for most tax-related matters, it’s important to remember that for highly specialized cases or strategic financial decisions, consulting a professional tax advisor may still be necessary. However, for the majority of self-employed users, our AI Tax Advisor simplifies tax management and reduces the reliance on an accountant.

No, it is an Artificial Intelligence trained on Belgian tax law and thousands of questions from self-employed across hundreds of professions. It is not subject to the regulation applicable to certified accountants and tax advisors in Belgium.

The AI Tax Advisor is available to every user on the Accountable app and the Expert interface, the interface for accountants. Its goal is to help both the self-employed and accountants save time & gain access to better knowledge faster. As any AI, it can make mistakes and need to be monitored closely, incl. with the support of certified accountants and tax advisors.