As an independent in Belgium, you have to submit your VAT return periodically. This declaration contains a summary of VAT you’ve collected yourself via your sales invoices, and VAT you’ve paid on your professional purchases. Your VAT balance is calculated based on this return, and you find out whether you’re entitled to a VAT refund or have to pay.

In this guide, we take you step-by-step through the VAT return: from preparing it to submitting it via Intervat, to paying the outstanding balance. Let's go!

The periodic VAT return can be submitted either through a monthly return or a quarterly return.

Your VAT return or quarterly return must be submitted between the 1st and the 25th of the month following the quarter for which you need to file.

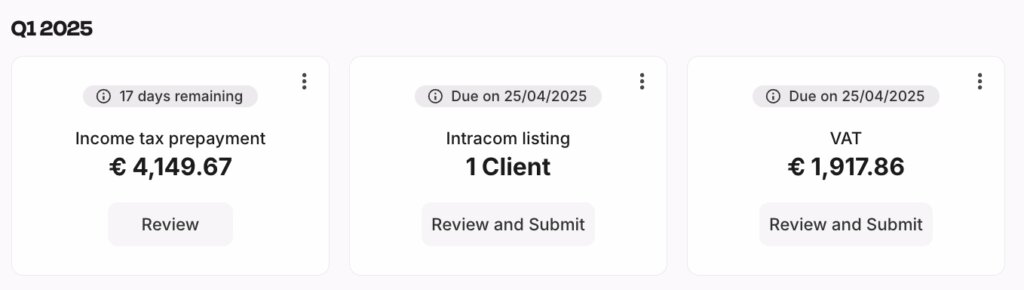

Note these VAT return deadlines in your calendar:

25-04-2025: payment and return for Q1

25-07-2025: payment and return for Q2*

25-10-2025: payment and return for Q3

25-01-2026: payment and return for Q4

*During the summer holidays, the deadline for submitting your VAT return is extended until 08/08/2025. This does not apply if you are due a VAT refund, and if you owe VAT, the payment deadline remains 25/07/2025.

Follow the step-by-step guide below to submit your VAT return quickly and easily yourself.

If you work with an accountant, chances are they’ll prepare your VAT return and maybe even submit it for you. It’s important to agree on this up front with your accountant to avoid any surprises.

Do you keep track of your VAT expenses and income yourself? In that case, grab them now, because in the next step, we’ll start working with them!

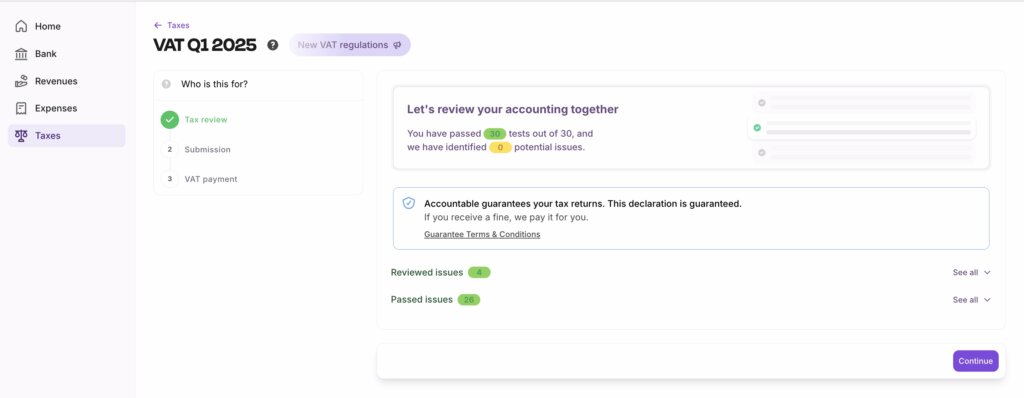

If you have systematically kept track of all your income and expenses in Accountable, you’ll be able to create the VAT return in just a few clicks. That saves you a lot of time and work. Easy, right?

Are you an Accountable user?

First, check that all your income and expenses are in Accountable. The best way is to prepare your sales invoices in Accountable or upload them systematically. The same goes for all receipts and purchase invoices; add them as soon as you receive them.

In the web version of Accountable, go to the 'Taxes' tab.

Now that you’ve passed all the checks, it’s time to submit your VAT return. You can do this with just one click, directly from our app.

Next, a quick authentication will follow to give Accountable permission to submit your VAT return via Intervat.

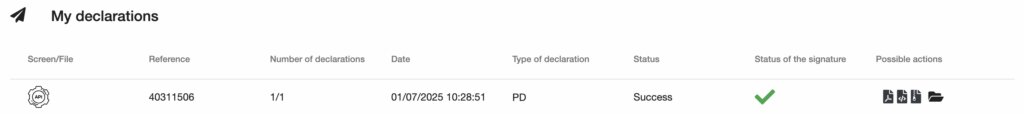

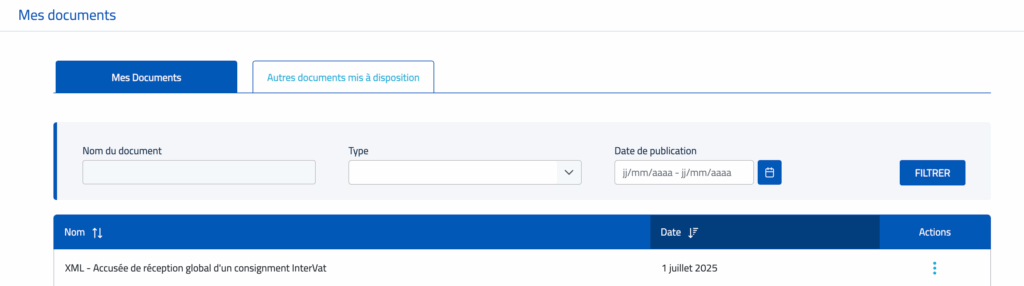

Yes! Your VAT return has now been submitted to Intervat.

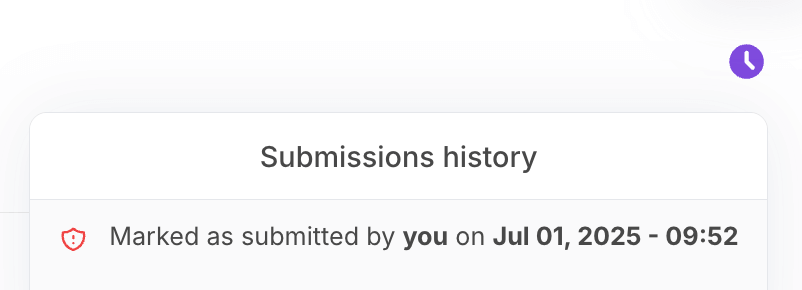

You can view your submitted VAT return at any time via the ‘Submissions history’ button (clock icon) at the top right of your screen.

There are two ways to do this:

After successfully submitting your VAT return, you’re not quite finished yet.

Do you need to pay VAT?

Will you get a VAT refund?

In that case, you don’t need to do anything; the money will automatically appear in your account.

In the video below, I walk you through the step-by-step process of submitting your VAT return using Accountable.

If you have any questions, please don’t hesitate to contact me.

That’s it! Congrats, you’ve filed your VAT return all by yourself, with a little help from Accountable. Did you know that Accountable also lets you prepare and submit your customer listing and personal tax declaration yourself?

Author - Alexis Eggermont

Alexis is co-founder at Accountable. He is passionate about leveraging data, AI, technology, and entrepreneurship.

Who is Alexis ?Thank you for your feedback!

Useful

As a self-employed individual with a sole proprietorship, your income is taxed under the personal in...

Read moreStarting from 2026, all self-employed individuals will need to send their invoices electronically in...

Read moreThe VAT reverse charge is a complicated word for a simple concept. It helps you purchase and sell sm...

Read moreTop perfecte service

Amaury Philips

Thanks to Accountable I finally understood my finances and easily submitted all the declarations. They are always able to help with any of my questions, it is fast and realiable. 100% recommended!

Anonyme

Accountable est un logiciel que je trouve très simple à utiliser. L’interface offre une vue d’ensemble claire et suffisante pour gérer efficacement les informations importantes, sans complexité inutile. La prise en main est rapide, même sans connaissances approfondies, ce qui rend l’expérience fluide dès le départ. Le support par chat est particulièrement réactif et efficace ; les réponses arrivent rapidement et sont pertinentes. Cet accompagnement ajoute un réel confort et rend l’utilisation du logiciel encore plus agréable au quotidien.

Florian Duchâteau

Très intuitif

Anne-Claire Giffroy

snelle, vriendelijke en efficiënte helpdesk

Jan Theeuwes

Zeer aan te raden! Ik heb enorm veel bijgeleerd. Ze helpen je echt heel goed en nemen de tijd om alles uit te leggen. Ik wist helemaal niets over belastingen en dergelijke, en hoewel ik nog steeds niet alles weet, heeft Accountable mij echt enorm geholpen. Topservice!

Ahmet Sak

They always answer for questions wherever is via direct e-mail or through app. If they can’t answer fully they will forward you to the right place. Documents were always prepared well and ready to send further to government. Everything is intuitive in the app and easy to sort out even for someone completely green in this field.

Anonymous

Service Nickel.

Anonyme

Super équipe! Mon coach fiscal m'a répondu rapidement (moins de 24h) et la réponse était très pertinente, concrète et utile. Je suis hyper satisfaite. Merci !

Anonyme

merci pour tout ce que vous avez fait pour moi ça m'a aidée énormément

Cezary Apiecionek