Did you know that starting in 2026, e-invoicing will be mandatory for all self-employed people in Belgium? At least for B2B invoices.

Want to be ready for this deadline? With Accountable, you can already send electronic invoices. Here, we walk you through all the steps, from registering on Peppol to sending your invoice in Accountable.

To send and receive electronic invoices, you need to register on the Peppol network as a self-employed person. Peppol is a system that standardises and simplifies the exchange of electronic invoices within the European Union.

Good news: registering with Peppol is free and easy, for example via Accountable.

1. In Settings > Peppol, click on “Start registration”.

2. Complete the form or check the entered data and click “Continue”.

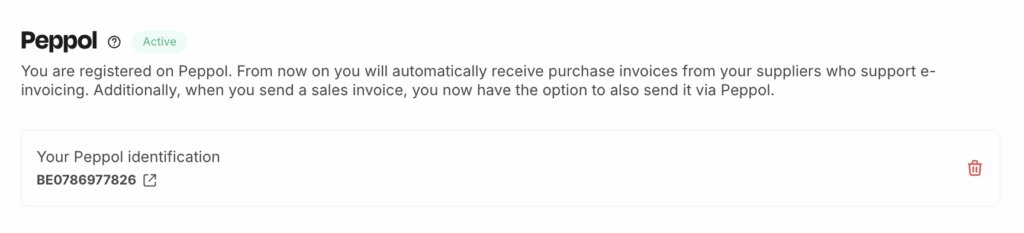

As of now, your registration on Peppol is pending. Wait until the status changes to “Active”. This can take anything from a few minutes to a few hours.

Note that your client must also be registered on the Peppol network to receive electronic invoices. As the obligation to use e-invoicing only applies from 2026, it may be that your client is not (yet) registered on Peppol. You can check this in Accountable.

1. Go to “Revenues” and create a new invoice.

Once you have filled in all the information and invoice details, click "Continue" then "Save & prepare to send".

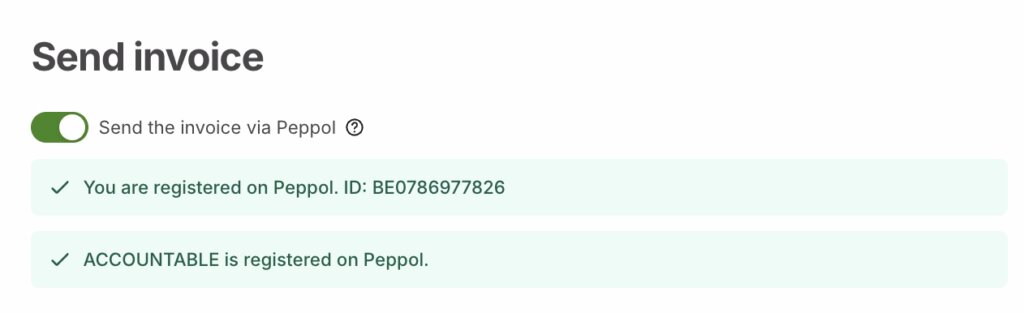

2. In the next window, enable “Send the invoice via Peppol”.

You can check if your client is registered on Peppol in the Peppol directory. Simply enter your client's name to see if they’re registered.

No, both you and your client must be registered on the Peppol network for you to be able to send them a Peppol invoice. If your client isn’t registered, you’ll need to send the invoice in another way (e.g. a PDF sent via email). Note that electronic invoicing becomes mandatory as of 2026.

Don't worry: if your client isn't registered on Peppol yet, you won't be able to send them an electronic invoice. You’ll receive an error message if you try.

Electronic invoicing won’t be mandatory for transactions between other EU member states until 2030. In some countries, like Germany, electronic invoicing is already in place, but in others, e-invoicing isn’t mandatory yet. Since the different platforms are not yet fully compatible with each other, there’s no obligation to send electronic invoices to clients in other EU member states, but it’s already possible to do so.

Do you still have questions about sending electronic invoices via Peppol? Contact our Tax Coaches.

Author - Alexis Eggermont

Alexis is co-founder at Accountable. He is passionate about leveraging data, AI, technology, and entrepreneurship.

Who is Alexis ?Thank you for your feedback!

Useful

As a self-employed individual with a sole proprietorship, your income is taxed under the personal in...

Read moreStarting from 2026, all self-employed individuals will need to send their invoices electronically in...

Read moreThe VAT reverse charge is a complicated word for a simple concept. It helps you purchase and sell sm...

Read morePrise de contact facile et cordiales, explications et informations clairs et précises pour quelqu'un qui débute dans ce domaine. Un merci particulier à Louise pour son retour rapide.

Jean-François Meysman

Réponse aux questions posées et rapide !

Patrick Huyghe

Ik vind de manier van werken heel prettig. Inscannen van kassaticketjes, uploaden van digitale tickets, opstellen van facturen, opvolgen van de betalingen én de helpdesk... allemaal TOP!

Tim De Sutter

Ik vind het zeer gebruiksvriendelijk, makkelijk om te contacteren en een vriendelijk en duidelijk antwoord

Lieve Bunkens

Ik stelde een vraag en op zeer korte tijd had ik een atwoord dat duidelijk was van Moïse.

Frank Van den Eynden

Merci pour votre aide rapide et très professionnelle. C est très précieux et apaisant de savoir que l on peut faire appel à vous. Merci à Romain.

Tim Peirce

Ik krijg altijd een duidelijk en overzichtelijk antwoord van de coaches. Zeer handig en reliable!

Keennan De Bie

Vous êtes très clairs dans vos explications, j’aime aussi la manière de communiquer (smiley etc..) c’est bien à l’ordre du jour et c’est chouette de voir cette dynamique 👍

Thomas Van Gyzeghem

Tot nu toe zeer goede ervaring en vlotte communicatie.

Guido Jacobs

réactivité et clarté de la communication

"Philippe DE DEYN"