As an independent in Belgium, you have to submit your VAT return periodically. This declaration contains a summary of VAT you’ve collected yourself via your sales invoices, and VAT you’ve paid on your professional purchases. Your VAT balance is calculated based on this return, and you find out whether you’re entitled to a VAT refund or have to pay.

In this guide, we take you step-by-step through the VAT return: from preparing it to submitting it via Intervat, to paying the outstanding balance. Let's go!

The periodic VAT return can be submitted either through a monthly return or a quarterly return.

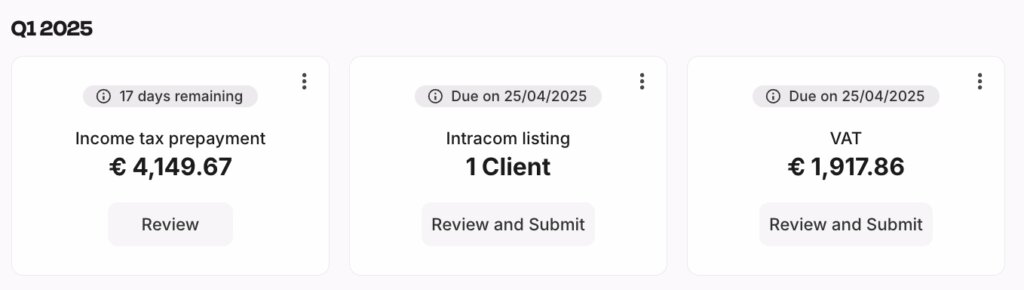

Your VAT return or quarterly return must be submitted between the 1st and the 25th of the month following the quarter for which you need to file.

Note these VAT return deadlines in your calendar:

25-04-2025: payment and return for Q1

25-07-2025: payment and return for Q2*

25-10-2025: payment and return for Q3

25-01-2026: payment and return for Q4

*During the summer holidays, the deadline for submitting your VAT return is extended until 08/08/2025. This does not apply if you are due a VAT refund, and if you owe VAT, the payment deadline remains 25/07/2025.

Follow the step-by-step guide below to submit your VAT return quickly and easily yourself.

If you work with an accountant, chances are they’ll prepare your VAT return and maybe even submit it for you. It’s important to agree on this up front with your accountant to avoid any surprises.

Do you keep track of your VAT expenses and income yourself? In that case, grab them now, because in the next step, we’ll start working with them!

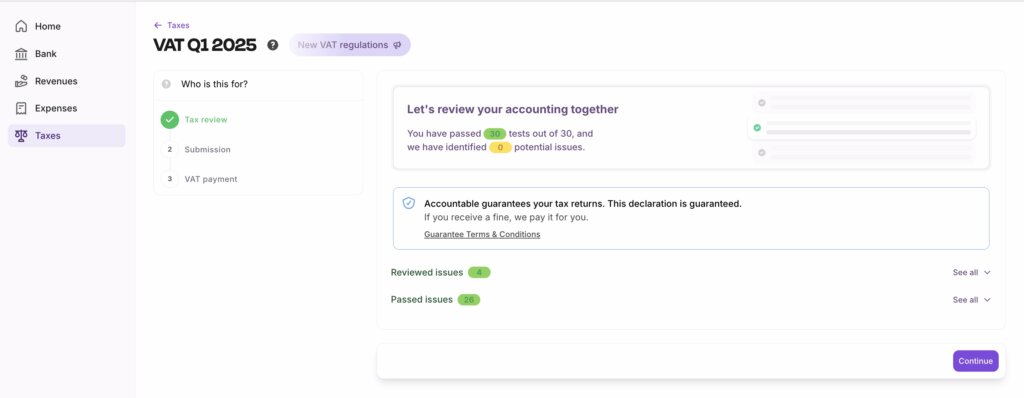

If you have systematically kept track of all your income and expenses in Accountable, you’ll be able to create the VAT return in just a few clicks. That saves you a lot of time and work. Easy, right?

Are you an Accountable user?

First, check that all your income and expenses are in Accountable. The best way is to prepare your sales invoices in Accountable or upload them systematically. The same goes for all receipts and purchase invoices; add them as soon as you receive them.

In the web version of Accountable, go to the 'Taxes' tab.

Now that you’ve passed all the checks, it’s time to submit your VAT return. You can do this with just one click, directly from our app.

Next, a quick authentication will follow to give Accountable permission to submit your VAT return via Intervat.

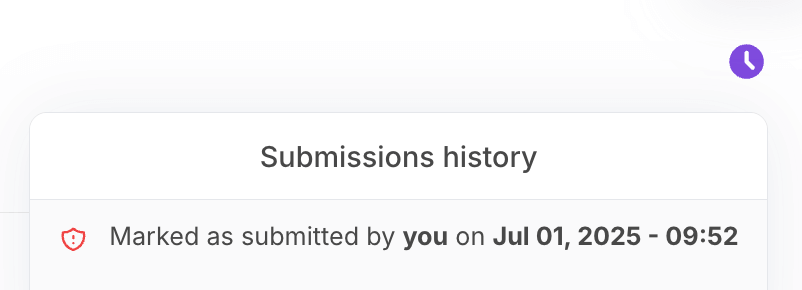

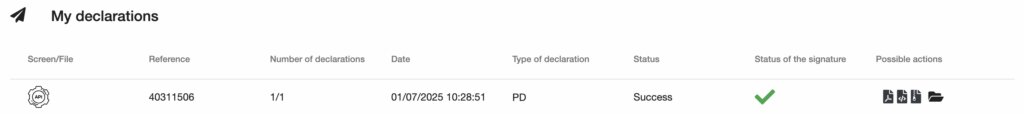

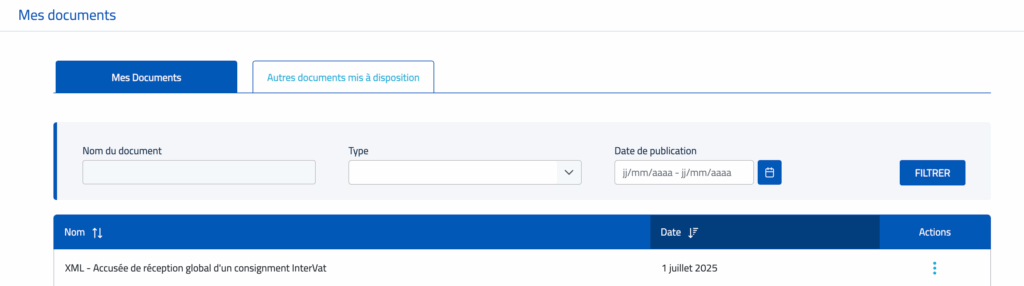

Yes! Your VAT return has now been submitted to Intervat.

You can view your submitted VAT return at any time via the ‘Submissions history’ button (clock icon) at the top right of your screen.

There are two ways to do this:

After successfully submitting your VAT return, you’re not quite finished yet.

Do you need to pay VAT?

Will you get a VAT refund?

In that case, you don’t need to do anything; the money will automatically appear in your account.

In the video below, I walk you through the step-by-step process of submitting your VAT return using Accountable.

If you have any questions, please don’t hesitate to contact me.

That’s it! Congrats, you’ve filed your VAT return all by yourself, with a little help from Accountable. Did you know that Accountable also lets you prepare and submit your customer listing and personal tax declaration yourself?

Author - Alexis Eggermont

Alexis is co-founder at Accountable. He is passionate about leveraging data, AI, technology, and entrepreneurship.

Who is Alexis ?Thank you for your feedback!

Useful

As a self-employed individual with a sole proprietorship, your income is taxed under the personal in...

Read moreStarting from 2026, all self-employed individuals will need to send their invoices electronically in...

Read moreThe VAT reverse charge is a complicated word for a simple concept. It helps you purchase and sell sm...

Read moreGoede feedback en snel

Frank Mercado Avalos

Heb reeds meerdere contacten mogen hebben met de belastingcoaches. De coaches zijn deskundig en coöperatief. Een dikke pluim !

Henry Voortmeijer

Geen kennis ,Accountable en is overzichtelijk en gemakkelijk. Alvast bedankt!

Patrick Vranckx

en soi je n'ai rien a reprocher pour l'instant à l'application. La seule chose que je pense ou il faut mettre plus de lumiere les demandes fiscales qui attendent les nouveaux entrepreneurs ( en complementaire.) de faire plus de video ludiques. pour ne pas se retrouver dans ma situation ou on se rend pas compte de vraiment compte de l'impacte fiscale de se lancer.

Patrick Ilunga Kazadi kambilala

Vlot duidelijk

Luc Mertens

À l’écoute et réactif

Jawad El boudakhani

De adviseurs antwoorden snel en spreken duidelijke taal. Zo had ik laatst een factuur voor de herstelling van een voorruit van de wagen waarvan ik enkel de helft van de BTW moest betalen en recupereren. De adviseur kwam terug met een kort stappenplan om deze correct te boeken.

Pascal Eraerts

Tout est au top!

Benoit Vander Stappen

Zeer tevreden met respons van jullie!

Kristof Maenhout

rapide, clair, précis

Laurence Vanrie