Discovered a mistake in your VAT return after submitting it via Intervat? You’re certainly not the only one. The good news is that you can correct your error, as long as the statutory filing deadline has not passed. Previously, it was also possible to submit a correction to your VAT return after the statutory filing deadline, but as of 1 January 2025, this will no longer be allowed.

But how can you still rectify a mistake? Let's dive into it.

From this year, several changes to VAT regulations will come into effect. New deadlines for the submission and filing of periodic returns are being introduced, and the ability to correct errors in your VAT return after the statutory filing deadline has passed will be abolished.

But what should you do if you discover a material error in your VAT return after the statutory filing deadline? In that case, you can include a correction in your next return.

Before the statutory filing deadline passes, you can still correct your mistake. You do this by cancelling the previous return and replacing it with the correct one.

⚠️ Please note, this is only possible if the statutory filing deadline has not yet passed!

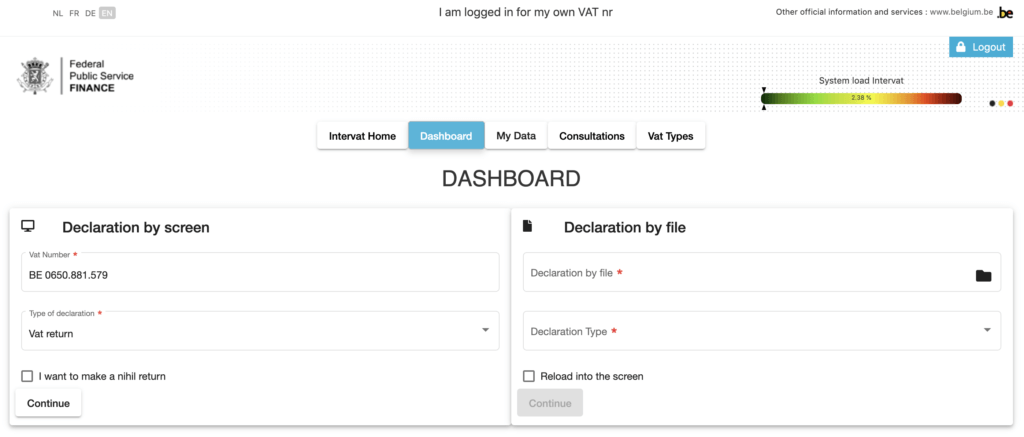

Go to Intervat (you can use this link) and log in.

If you want to adjust a return for your sole proprietorship, select "in own name." If you have a company, select "on behalf of a business."

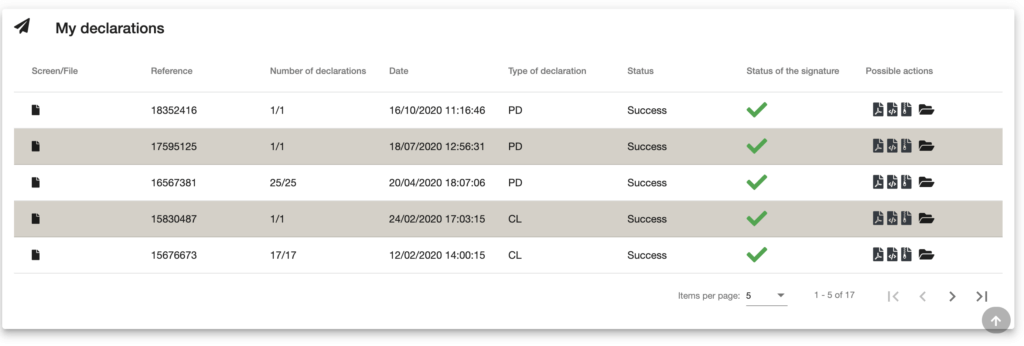

Go to 'My declarations' and cancel the previous return.

Then upload the correct return. You can do this as you normally would, either by file or by screen.

Don't understand something about Intervat or have a question about your VAT return? Feel free to contact our Tax Coaches. We’re here to help. ✨

Not using Accountable yet? Through our app, you can easily access all the information you need to submit your VAT return without errors. Plus, we offer a guarantee for your tax returns. If you receive a fine, we’ll cover it.

Author - Artyom Ghazaryan

Artyom is Head of Accounting at Accountable, and a chartered Accountant & Tax Specialist.

Who is Artyom ?Thank you for your feedback!

Useful

As a self-employed individual with a sole proprietorship, your income is taxed under the personal in...

Read moreStarting from 2026, all self-employed individuals will need to send their invoices electronically in...

Read moreThe VAT reverse charge is a complicated word for a simple concept. It helps you purchase and sell sm...

Read moreHeel duidelijk en uitgebreid platform, veel informatie voor starters beschikbaar die mooi verwijst naar waar het platform mee kan helpen.

Kristof Buts

Je krijgt altijd het juiste antwoord op jou vragen. De medewerkers helpen jou altijd waar nodig. Opvolging is hun standaard! Gewoon top!

Seppe Fabry

Ik ben nog maar net zelfstandig en begrijp nog niet alles, waardoor mijn vragen soms wat “dom” kunnen overkomen. Toch nam Anouar echt de tijd om alles tot in detail uit te leggen. Zelfs wanneer ik een foute term gebruikte, legde hij meteen uit waarom dat zo was, ook al ging mijn vraag daar eigenlijk niet over. Daardoor heb ik zelfs méér bijgeleerd dan ik oorspronkelijk vroeg. Hij was super vriendelijk, antwoordde razendsnel, en binnen een uurtje was alles opgelost. Hij stuurde zelfs screenshots met uitleg en linkte relevante artikels. Echt fantastische hulp van Anouar, enorm bedankt!

Tedi Ivanova

Magamed heeft me super geholpen met alle vragen die ik had, in maart neem ik zeker verder contact op voor verdere aanpassing maar alle vragen die ik had werden perfect uitgelegd naar me!

Brian Masschelein

J'ai apprécié le contact aimable. J'ai un compte gratuit. Pouvoir avoir accès via ordinateur, sans passer par un smartphone serait un avantage important.

Anonyme

J’ai apprécié la simplicité d’utilisation d’Accountable et la clarté de l’interface. Les démarches sont bien expliquées, ce qui facilite vraiment la gestion administrative. Le service client est aussi réactif et professionnel, c’est rassurant. Pour l’amélioration, peut-être encore plus de tutoriels ou de guides pour les nouveaux utilisateurs afin de découvrir toutes les fonctionnalités plus rapidement.

Yvan-Loïc MAGNING SIMO AKONG

Comment me guider pour résoudre mon problème. J'ai vraiment apprécié la manière de me montrer et colmater mes lacunes

Madjid Taguemount

Top perfecte service

Amaury Philips

Thanks to Accountable I finally understood my finances and easily submitted all the declarations. They are always able to help with any of my questions, it is fast and realiable. 100% recommended!

Anonyme

Accountable est un logiciel que je trouve très simple à utiliser. L’interface offre une vue d’ensemble claire et suffisante pour gérer efficacement les informations importantes, sans complexité inutile. La prise en main est rapide, même sans connaissances approfondies, ce qui rend l’expérience fluide dès le départ. Le support par chat est particulièrement réactif et efficace ; les réponses arrivent rapidement et sont pertinentes. Cet accompagnement ajoute un réel confort et rend l’utilisation du logiciel encore plus agréable au quotidien.

Florian Duchâteau