End-of-year holidays are the perfect time to surprise your loyal customers with a business gift. This is a great way to strengthen ties while optimising your taxes, and sometimes you can even recover the VAT paid. But business gifts needn’t be limited to the holiday season – you can spoil your customers at any time of the year.

However, there’s a lot of uncertainty around business gifts, as various tax and VAT rules can come into play. For example, a particular business gift may be tax deductible, but you can’t recover the VAT. Fortunately, in this case, you can include the non-deductible VAT in your tax return, in addition to the purchase price.

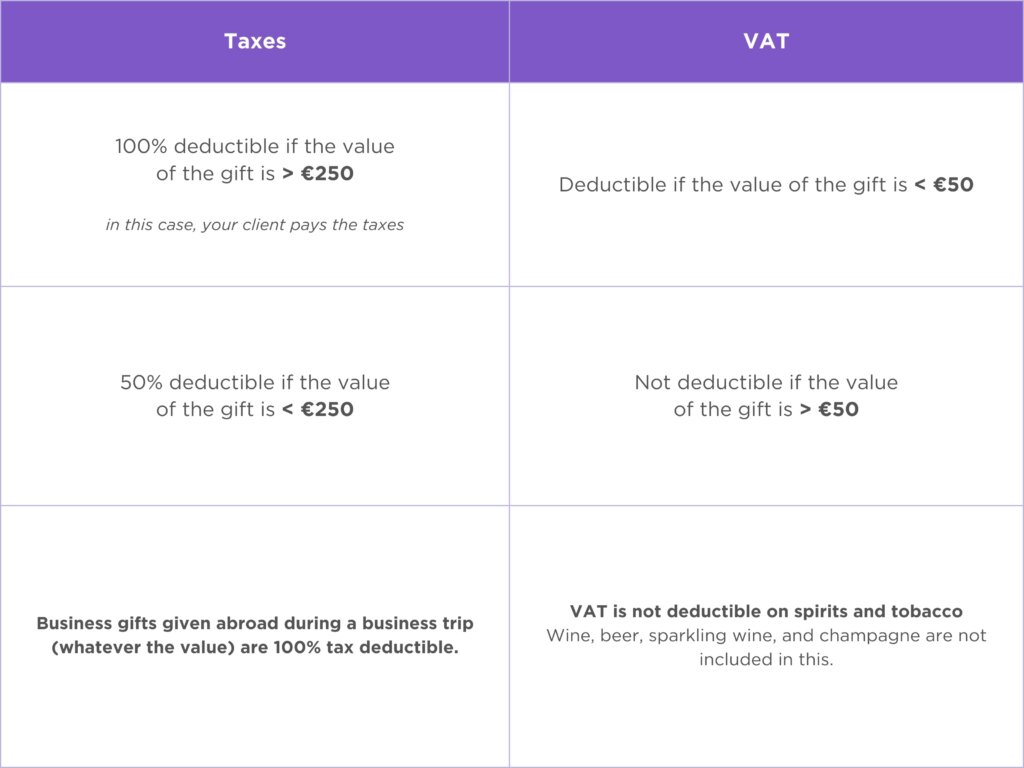

The general rule for tax deduction of business gifts is as follows: business gifts are 50% tax deductible if they have a value of less than €250 (excluding VAT).

An example:

If you give your customer, employee or business acquaintance a gift worth €90, you can deduct €45 from your taxable income. If you’re a sole trader and are taxed in the highest income tax bracket (50%), you’ll get back €22.50 from this purchase. The remaining €67.50 (€90 - €22.50) still comes from your own pocket.

If you have a company, you’ll recover 25% of the €45 via corporate tax; in other words, around €11.25 of tax benefit for a business gift of €90.

Business gifts with a value of more than €250 are fully deductible from your taxes. However, there’s one big condition here.

These gifts are considered benefits in kind for the recipient, who will then also have to pay tax on them.

This means you’ll need to issue a '281.50' tax form for these gifts to your clients, and they’ll need to declare them in their own tax return. You can fully deduct the cost of these gifts from your taxes, but clients will generally not be happy to receive a gift they have to pay tax on. So it’s best to stay below the €250 limit and ensure your business gift really is a gift.

If you give a business gift while on a business trip abroad, it’s 100% deductible against your taxes. It doesn’t matter how much it’s worth or where you bought it. If you’re on a business trip with a client or supplier, this is therefore the perfect time to give your business gift, even if it’s worth more than €250. However, you’ll need to be able to prove that you were both abroad, for example, thanks to your hotel and restaurant receipts.

The VAT deduction on business gifts for your clients or business contacts works differently from the income tax deduction.

If the value of your gift to your customer is less than €50 (excluding VAT), the VAT is fully deductible, but for a maximum of one gift per customer per calendar year. It’s therefore a good idea to keep a list of customers you’ve given a business gift to.

If the value of your gift is more than €50, then you’ll have to pay the VAT. However, you can add this VAT to the purchase price and deduct it in your tax return.

⚠️ For tobacco and spirits, the VAT can never be recovered, regardless of the value of the gift. This isn’t the case for wine, beer, champagne or sparkling wine. The VAT on a bottle of bubbles is therefore deductible, provided it costs less than €50. So, a Veuve-Clicquot could still make for a nice business gift. 😉

Do you produce samples so your customers can discover your products? Do you have your logo printed or engraved on small gadgets that you give to your customers and prospects? These items fall under the category of promotional material, and are subject to some specific rules.

Promotional material is fully tax deductible, and the VAT is also fully recoverable. This is provided the product has a limited value, is widely distributed to the general public, and that your company name or logo is indelibly present on the item(s).

⚠️ Consumer items such as wine and chocolate aren’t considered as 'promotional material', but instead follow the rules for business gifts.

At Accountable, we’re here to make your life easier, which is why we've summarised the rules in a handy overview.

Business gifts have a double advantage: they strengthen your relationships with your customers and, at the same time, optimise your taxes and VAT. In the Accountable app, you record these expenses under the category 'Marketing'. You can choose between 'Business gift' and 'Advertising'. This way, the expense will be registered correctly, both for your taxes and for VAT.

In principle, client gifts are limited to one per client relationship, per year. At least if you want to reclaim the VAT. Here are the rules: if the value of the business gift is less than €50, the VAT is fully deductible. If the value is higher, you pay the VAT. For tax deductibility, the limit is set at €250 (50% deductible). If your gift exceeds €250, it’s fully tax deductible for you, but your client will have to pay taxes on it.

Yes, business gifts for your business relations, customers and even your staff are deductible in Belgium, both for VAT and for tax. You recover the VAT in full if the value of the gift for the customer is less than €50. For VAT recoverability, gifts are limited to one per customer, per year. For taxes, if the value of the gift is less than €250, it’s 50% deductible. If it’s more expensive, the gift is fully deductible for you for tax purposes, but your customer will have to pay taxes. A point to watch!

VAT on business gifts is 100% deductible if the value is less than €50, provided only one gift is given per customer, per year. In addition, the gift is 100% tax deductible if the value is €250 or more. However, be careful, because in this case, your customer will have to pay tax on the gift. If the value is less than €250, this is not the case and the tax deductibility is 50%. Business gifts offered abroad during a business trip are 100% tax deductible, regardless of the value. You’ll then have to prove that you were actually abroad with your customer.

Author - Nicolas Quarré

Nicolas is co-founder and CEO at Accountable. His vision for the company has always been clear: free self-employed from administrative nightmares.

Who is Nicolas ?Thank you for your feedback!

Useful

As a self-employed individual with a sole proprietorship, your income is taxed under the personal in...

Read moreStarting from 2026, all self-employed individuals will need to send their invoices electronically in...

Read moreThe VAT reverse charge is a complicated word for a simple concept. It helps you purchase and sell sm...

Read more