Discovered a mistake in your VAT return after submitting it via Intervat? You’re certainly not the only one. The good news is that you can correct your error, as long as the statutory filing deadline has not passed. Previously, it was also possible to submit a correction to your VAT return after the statutory filing deadline, but as of 1 January 2025, this will no longer be allowed.

But how can you still rectify a mistake? Let's dive into it.

From this year, several changes to VAT regulations will come into effect. New deadlines for the submission and filing of periodic returns are being introduced, and the ability to correct errors in your VAT return after the statutory filing deadline has passed will be abolished.

But what should you do if you discover a material error in your VAT return after the statutory filing deadline? In that case, you can include a correction in your next return.

Before the statutory filing deadline passes, you can still correct your mistake. You do this by cancelling the previous return and replacing it with the correct one.

⚠️ Please note, this is only possible if the statutory filing deadline has not yet passed!

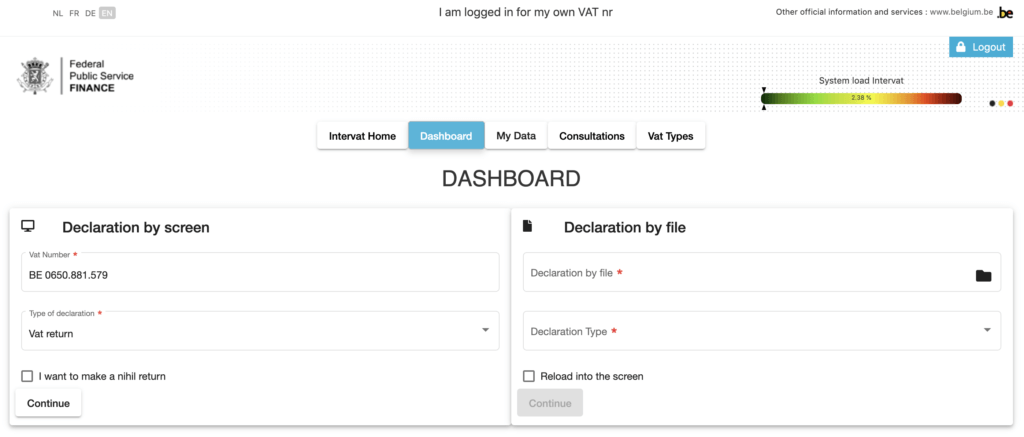

Go to Intervat (you can use this link) and log in.

If you want to adjust a return for your sole proprietorship, select "in own name." If you have a company, select "on behalf of a business."

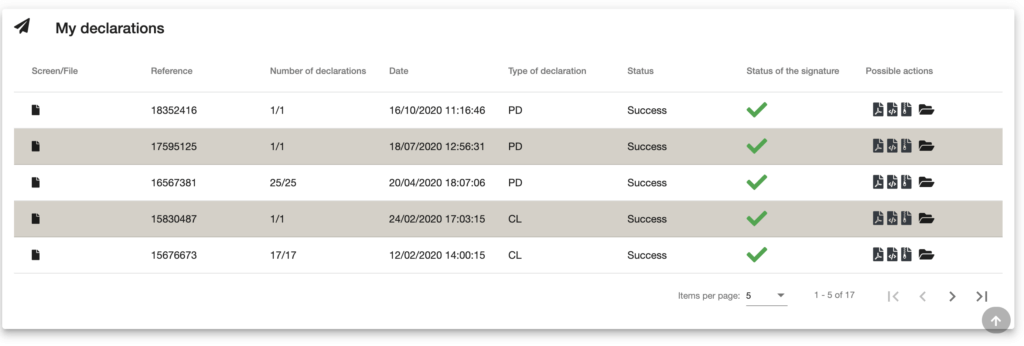

Go to 'My declarations' and cancel the previous return.

Then upload the correct return. You can do this as you normally would, either by file or by screen.

Don't understand something about Intervat or have a question about your VAT return? Feel free to contact our Tax Coaches. We’re here to help. ✨

Not using Accountable yet? Through our app, you can easily access all the information you need to submit your VAT return without errors. Plus, we offer a guarantee for your tax returns. If you receive a fine, we’ll cover it.

Author - Artyom Ghazaryan

Artyom is Head of Accounting at Accountable, and a chartered Accountant & Tax Specialist.

Who is Artyom ?Thank you for your feedback!

Useful

As a self-employed individual with a sole proprietorship, your income is taxed under the personal in...

Read moreStarting from 2026, all self-employed individuals will need to send their invoices electronically in...

Read moreThe VAT reverse charge is a complicated word for a simple concept. It helps you purchase and sell sm...

Read moreTrès intuitif

Anne-Claire Giffroy

snelle, vriendelijke en efficiënte helpdesk

Jan Theeuwes

Zeer aan te raden! Ik heb enorm veel bijgeleerd. Ze helpen je echt heel goed en nemen de tijd om alles uit te leggen. Ik wist helemaal niets over belastingen en dergelijke, en hoewel ik nog steeds niet alles weet, heeft Accountable mij echt enorm geholpen. Topservice!

Ahmet Sak

They always answer for questions wherever is via direct e-mail or through app. If they can’t answer fully they will forward you to the right place. Documents were always prepared well and ready to send further to government. Everything is intuitive in the app and easy to sort out even for someone completely green in this field.

Anonymous

Service Nickel.

Anonyme

Super équipe! Mon coach fiscal m'a répondu rapidement (moins de 24h) et la réponse était très pertinente, concrète et utile. Je suis hyper satisfaite. Merci !

Anonyme

merci pour tout ce que vous avez fait pour moi ça m'a aidée énormément

Cezary Apiecionek

Goede opvolgging

Thomas Van audenhoven

Iris a été très réactive et clair dans ses réponses. c'est parfait

Aurore Henrotte

Administratie is niet mijn sterkste punt. Dankzij Accountable behoud ik echter een duidelijk overzicht van al mijn inkomsten en uitgaven, die bovendien vlot opgevolgd kunnen worden door mijn boekhouder.

Mattias De Wit