When you’re self-employed in Belgium, you pay social security contributions every quarter. But what happens if you pay too much and then get a refund of the extra contributions you paid?

That’s good news for your bank account, but how do you correctly report this refund of (part of) your social security contributions and pay the right taxes on it? Find out in this article.

Need a refresher on how social security contributions are calculated and why you need to pay them? Read everything you need to know about social security contributions for the self-employed in 2025 here.

As a self-employed person, you pay provisional social security contributions every quarter. After around two years, FPS Finance communicates your actual income to your social security fund. If the estimated income used to calculate your provisional contributions was higher than your actual income, you’ll get back the extra amount you paid.

Your social security fund notifies you and automatically transfers the money to your account, unless you still have an outstanding debt. In this case, the money is used to settle the debt. Note that this only applies to late payments. You still need to pay your contribution for the current quarter.

Your actual income never exactly matches the estimated income on which your social security contributions are calculated, and that’s normal. This is why, after 2 or 3 years, you’re always in one of two situations: either you get some money back, or you have to pay extra. It’s roughly the same principle as when you file your tax return.

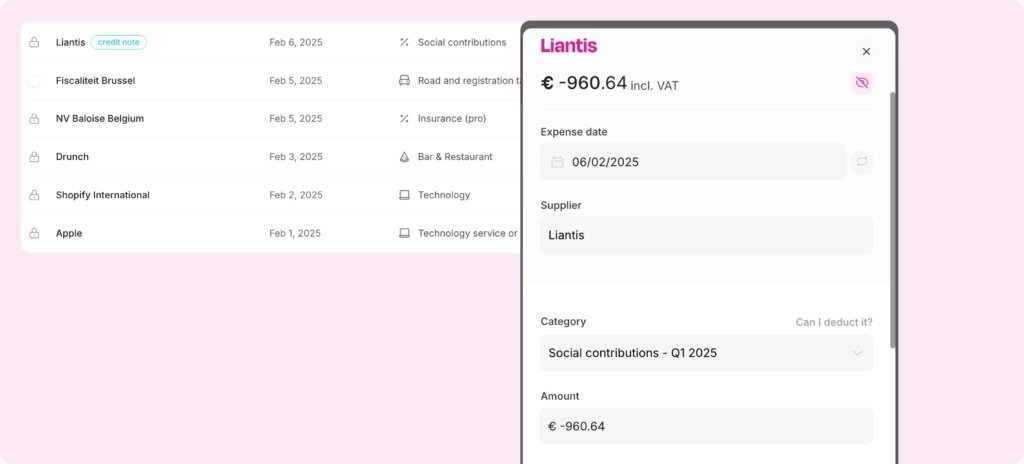

You paid provisional contributions in 2023. In the end, your actual income for that year turned out to be lower. Your social security contributions are recalculated, and you’ll get €960.64 back from your social security fund in 2025.

Not bad, right? But how do you reflect these refunded social security contributions in your accounting?

Now for the less good news: you have to pay taxes on any social security contributions that are refunded.

Why? Well, social security contributions are 100% deductible. They reduce your profits and, consequently, the income tax you have to pay. The overpaid contributions were therefore wrongly recorded as business expenses.

That’s why you need to add any reimbursement of social security contributions to your income. This is done in section XIX of your tax return. Declare the reimbursement under code 1206/2206 (code 50), "Remboursement de cotisations sociales” / “Teruggave van sociale bijdragen” (i.e. reimbursement of social security contributions). This amount will be added to your taxable income.

Let's say you get a refund in 2025 for social security contributions you overpaid in 2023. This refund needs to be included in your tax return for 2025 income (tax year 2026), even though the original payment was made in an earlier year (2023).

This is one of the rare cases where an accounting operation is carried out in one year and then corrected for tax purposes in a different year.

Are you getting a refund of the extra social security contributions you paid? Great! But don't forget to record them correctly, both from an accounting and tax perspective. In your accounting, treat the refund as a negative cost. In your tax return, enter the refunded amount under code 1206/2206 (50).

This way, everything is transparent and you'll avoid any surprises from the tax authorities. Accountable likes to make things easier for you. Our app calculates the exact amount of social security contributions you need to pay and reminds you to pay them.

Try Accountable free for 14 days!

Sometimes you don't get a refund, but instead have to pay extra social security contributions. If this happens to you, simply record the payment as an additional cost for the year in which you pay it. This cost is tax-deductible, just like your regular social security contributions.

Note that the tax authorities only take into account the contributions you actually paid during the calendar year in question. Did you pay an additional amount in 2025 for 2023? Then deduct it on your tax return for your 2025 income (tax year 2026).

You can happen that you receive a refund that’s higher than what you actually paid that year in social security contributions, for example, due to a correction from several previous years. This isn’t something to worry about. Simply enter the amount received as a negative cost, or credit note. The tax authorities will automatically record the correct distribution over the relevant years via your tax return.

It’s normal for your actual income not to match your estimated or provisional income exactly. However, if you find that you’re paying considerably too much (or too little) in social security contributions, consider adjusting the amount of your social security contributions.

Author - Valesca Wilms

As content marketing lead at Accountable Belgium, Valesca writes about freelancing, self-employment, and taxes based on her own experience as a freelancer.

Who is Valesca ?Thank you for your feedback!

Useful

As a self-employed individual with a sole proprietorship, your income is taxed under the personal in...

Read moreStarting from 2026, all self-employed individuals will need to send their invoices electronically in...

Read moreThe VAT reverse charge is a complicated word for a simple concept. It helps you purchase and sell sm...

Read more